How much should you have in an emergency fund?

How much should you have in an emergency fund?

How much should you have in an emergency fund?

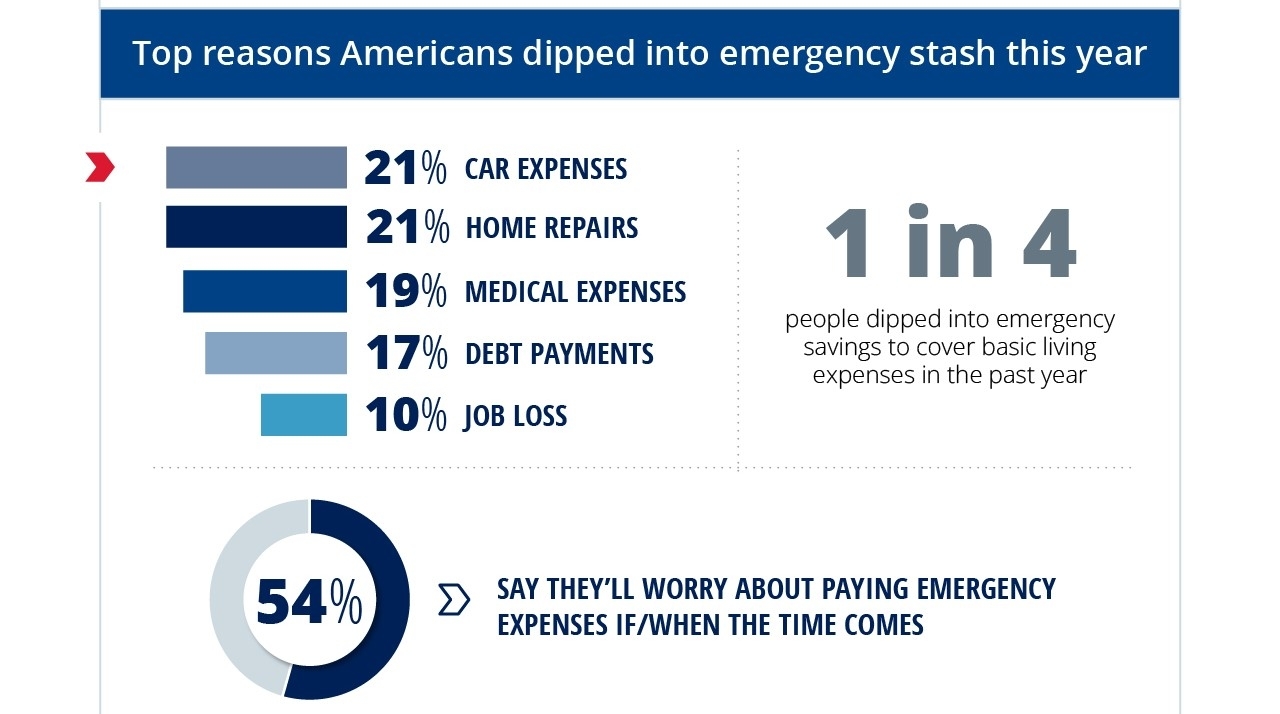

An emergency fund can serve as a safety net for life’s unexpected financial setbacks. Yet, Empower research reveals more than 1 in 5 (21%) Americans have no emergency savings set aside for unexpected financial events such as job loss, home and car repairs, and medical bills. Nearly 2 in 5 (37%) couldn’t afford an emergency expense over $400.

Preparing for a potential financial emergency can give you peace of mind that your essential expenses will be covered in turbulent times. So, how much should you have in an emergency fund?

When it comes to emergency savings, there are varying opinions about how much cash you should have or where it should be kept. How much is too much cash? What is too little?

There is a “just right” number — but it is highly individualized and subject to change, which explains a lot of the confusion. Where you keep your cash, however, is more clear-cut.

How much should you save in your emergency fund?

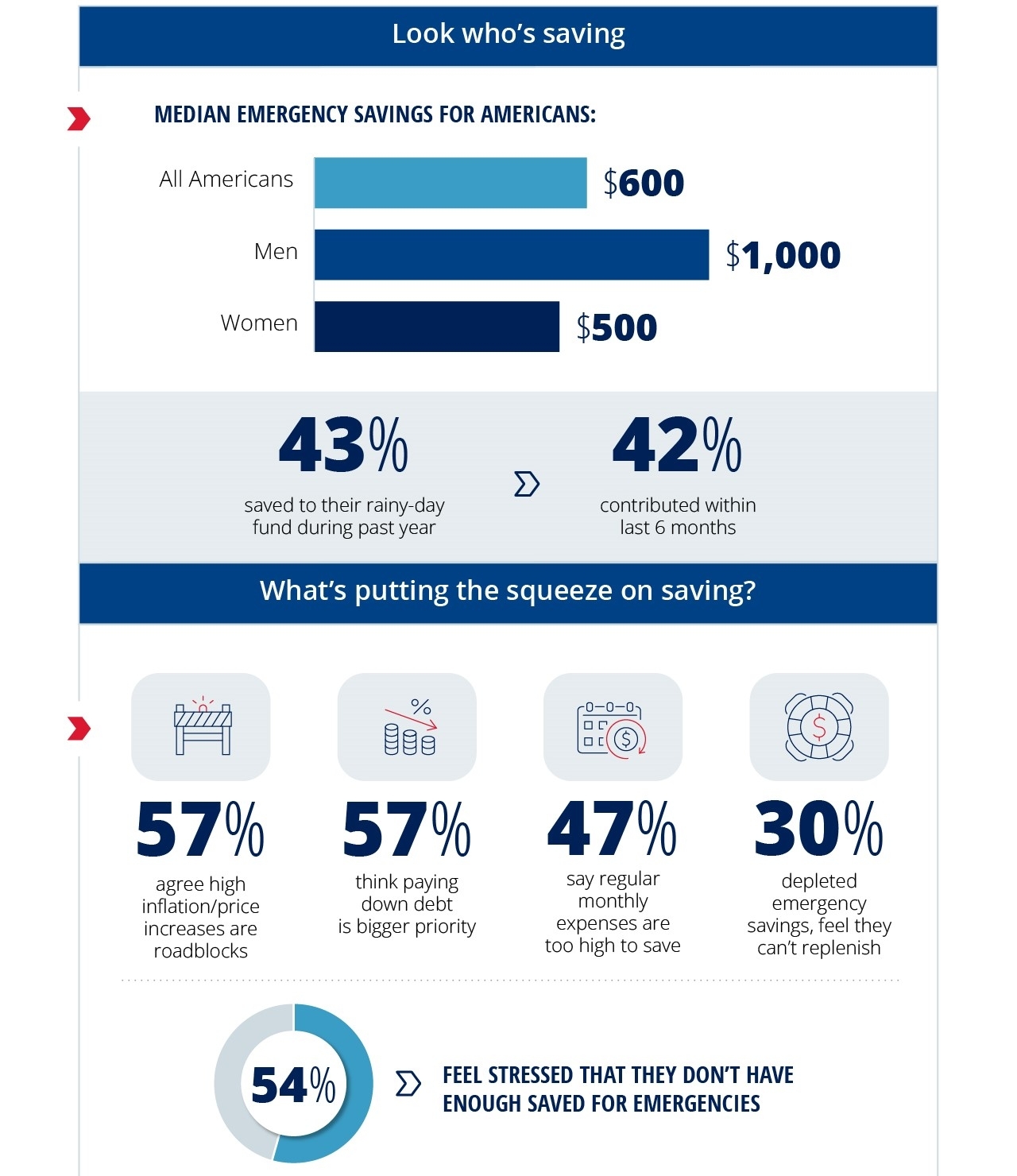

Saving enough cash to cover three to six months of expenses based on your average monthly spending is a good goal.1 Yet Americans have accumulated a median emergency savings of just $600, according to Empower research. Baby Boomers and Gen Xers have put aside the most for the unforeseen with median savings of $1,000 and $868, respectively, and Millennials and Gen Zers the least with median savings of $500 and $200, respectively. The median savings for men sits at $1,000 — twice as much as the median savings for women.

Finding what amount works best for will requires getting personal. First, calculate your monthly earnings and your average monthly spending. This number can exclude non-essential spending, such as dining out, travel, or shopping. Just concentrate on your unavoidable costs, such as housing, utilities, healthcare, transportation, food, debt or credit card payments, or other expenses.

Then, add up your current savings. Do you have enough in savings in case you lose your job or have a minor emergency? Consider how much you're setting aside monthly, as well as how soon you’d like to achieve your savings goal.

Once you determine how much you need for one month, consider how many months you’d like to save for. Picking your multiplier depends on your personal circumstances. Is your job secure? Do you have a family depending on your income? Do you have other sources of income?

If you are healthy, have a working spouse and no children, three months of savings will likely suffice. If you support children, have one income source, or simply want to have a larger safety net, six months or more might be the right number. As your circumstances change, your savings goal may need adjustments, as well.

Once you have a well-considered, rational amount for your emergency-fund level, you’ve found your number.

Read more: 1 in 5 Americans have no emergency savings

Why is having an emergency fund so important?

Emergency funds are an important part of your financial plan. This money is designed to cover unexpected events like job loss, major medical bills, car repairs, and home repairs. In the past year, more than one third (35%) of Americans were able to steer clear of unexpected financial situations, but others tapped emergency savings to take care of day-to-day outlays, with 1 in 4 (25%) dipping into emergency savings to afford basic living expenses.

There is no shortage of financial curveballs that life may throw your way. Having enough money saved in a rainy-day fund will also give you invaluable peace of mind. If an emergency should occur, you have quick access to cash.

Where should you keep your emergency fund?

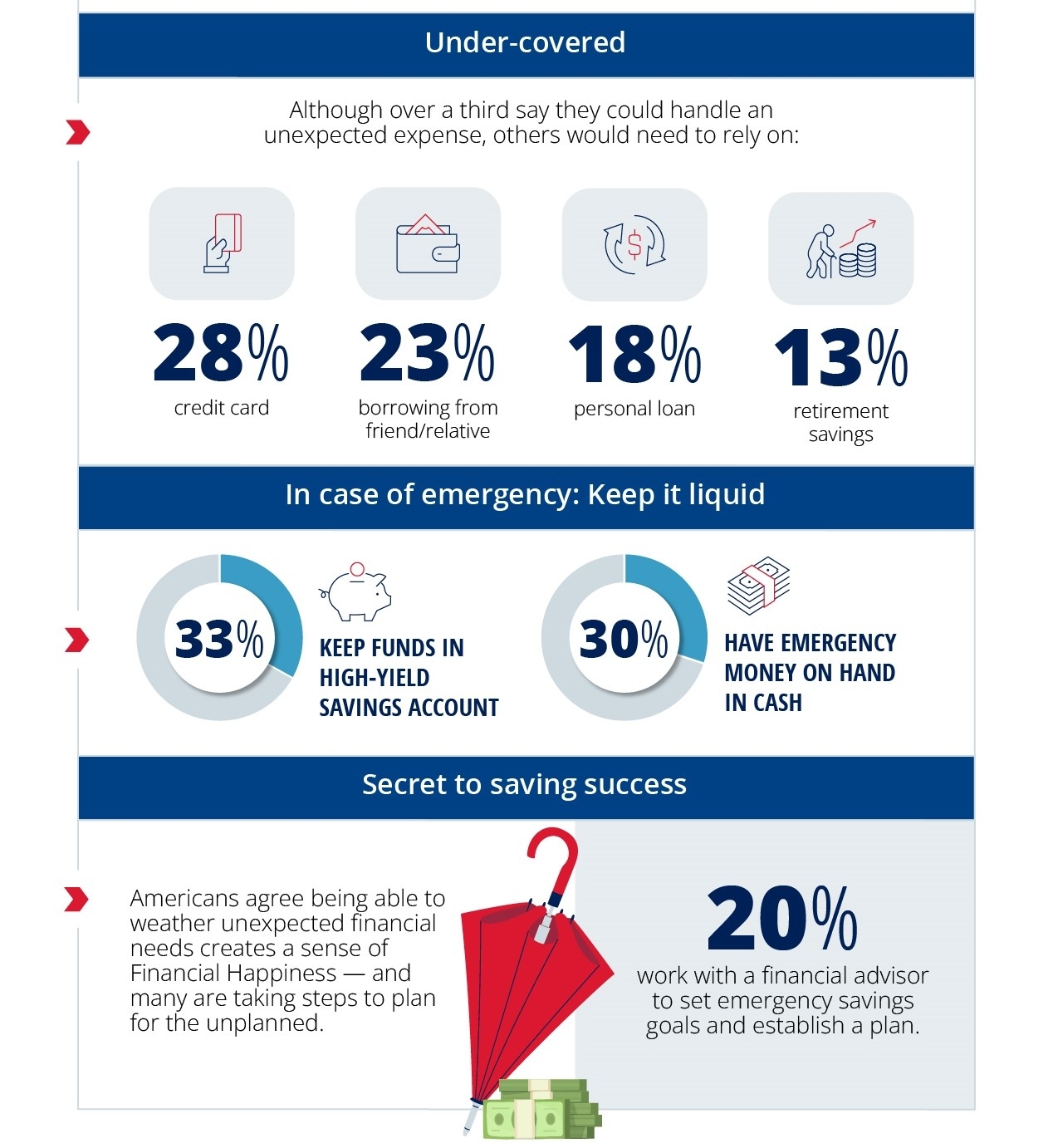

While how much cash you keep in emergency savings varies depending on life circumstances, where you keep your savings is much more clear-cut. Remember that your emergency cash is a long-term investment — you may never need to use it — with a short-term access requirement.

Because of this immediate access requirement, you may want a short-term investment vehicle that pays interest. There are several options, such as certificates of deposit (CDs), a high-yield savings account, or money market fund, among others.

Choosing an account that is FDIC insured, liquid (no major withdrawal or transfer restrictions), and has no banking fees can be a good idea. Make sure you read the fine print — you may be losing more to fees than you are earning in interest.

Read more: Saving money for long-term vs short-term financial goals

Our take

Identifying a personalized amount of emergency savings based on your individual circumstances is important to help ensure you have the right amount of cash on hand. If you have too much cash unnecessarily tied up in emergency savings, you may be undermining your long-term goals, such as retirement funding. It’s a balancing act.

How much you have saved in an emergency fund will depend on your unique situation but ensuring that you have a good safety net in place to cover unexpected expenses is a major pillar of any successful financial plan. In fact, more than 3 in 5 (62%) Americans say that having dedicated emergency savings is a priority for them. Nearly one-third (30%) stash emergency savings in cash. A safe, liquid account is generally a better place to park your emergency savings to ensure that your cash is still working for you while remaining easily accessible.

Get financially happy.

Put your money to work for life and play.

1 CNBC, “3 to 6 months of savings might be ‘tried and true wisdom’ but this expert has advice if you’re living paycheck-to-paycheck,” August 2022.

RO3749674-0724

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.