Empowering America’s Financial Journey™ Government Sector

Empowering America’s Financial Journey™

Government sector | 2024

Empowering America’s Financial Journey™

Government sector | 2024

The past year was filled with mixed financial indicators and challenges for public sector workers. High prices and rising interest rates affected the day-to-day finances of all Americans. But at the same time, the resiliency of government employees was on display: Retirement savings rates held steady, and more savers engaged with their retirement planning. Public sector workers also benefited from strong employment trends and higher market returns that contributed to a 12% increase in average retirement account balances.

Empowerʼs third annual Empowering Americaʼs Financial Journey (EAFJ) study for the government sector helps provide a clearer picture of how public sector employees are progressing on their journeys to financial freedom.

New to this year’s study is a unique analysis of how retirement planning differs across 10 government segments.

About the study

The study analyzes the behavior of approximately 1.9 million active participants in state and local defined contribution (DC) plans with Empower as the recordkeeper. The analysis provides an aggregate view of public DC plans, including 403(b), 457, 401(a), and 401(k) plans, which are available to different public employee segments. Unless otherwise noted, all data and exhibits are sourced from this analysis.

|

The study is structured across the following three themes: 1. Saving and engagement 2. Public sector segment analysis

3. Improving outcomes |

Key findings

|

The economy is still causing anxiety Inflation and rising costs of goods are contributing to financial stress for 85% of surveyed public sector workers. Rising interest rates and not saving enough for retirement are also financial stressors for more than half of workers. |

Retirement savings prioritized

Public sector workers are saving on average 6.4% of their income as of the end of 2023. By comparison, private sector workers, who mostly aren’t covered by pension plans, are saving 7.8%. Despite inflation and other financial stressors, savings rates fluctuated little throughout the year. Market appreciation helped boost average account balances in the public sector by 12% to $52,000.

Engagement is trending up

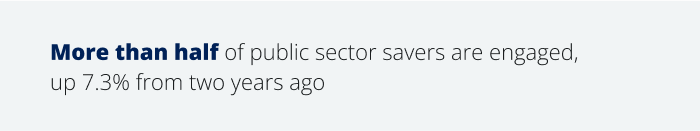

More than half of public sector savers (53%) are engaged, up 7.3% from two years ago. Engaged participants have savings rates 79% higher than unengaged savers. We define and measure engagement as at least one interaction with Empower’s workplace savings site, mobile apps, Customer Care Center, or advisory services.

| Engaged participants have savings rates 79% higher than unengaged savers |

Investment strategy

Compared to target date fund (TDF) users, savers using managed accounts are more engaged (69% vs. 48%) and save 28% more.

Gender retirement savings gaps

Women’s average savings rates are 10% less than men in the public sector, and their average account balances are 41% less. However, it’s important to note that the savings gap is less pronounced as income levels increase. Women making more than $120,000 have higher savings rates than men, and their average account balances are only 12% less than men’s in that income category.

Loans are less prevalent than in the private sector but are up year over year

Public sector savers taking out a new loan increased by 12%, and those taking a hardship withdrawal increased by 58%. Approximately 7% of public savers have an outstanding loan, half that of private sector workers (15%).

Paying down debt is a priority

Paying off debt was the most cited financial goal by 38% of surveyed government employees, followed closely by saving for retirement (37%).

Desire for advice

About half of surveyed public sector employees wish they had gotten advice earlier, and a third feel like they haven’t gotten the financial advice they need.

Public sector segment findings

Certain segments are outpacing private sector savings

Workers employed by public utilities and water authorities have the highest average public sector account balances ($113,000 and $103,000, respectively) and exceed the average account balance for private sector workers ($99,000).

Women’s average account balance is outpacing men’s in one of 10 public sector segments

Women’s average account balance is higher than men’s in the K-12 segment ($43,000 vs. $41,000). Women are also saving significantly more than men in this segment (10.5% vs. 9.2%)

Segment loan utilization can vary widely

Transportation and county workers took out loans at more than six times the rate of K-12 savers and at rates about 90% greater than the average public sector worker.

Investment strategies vary by segment

70% of hospital/healthcare savers are either using managed accounts or target date funds. Public safety savers take a different approach: More than three quarters of public safety savers use a do-it-yourself (DIY) investment strategy.

Public sector tenure is almost double the private sector

Active public sector savers have average tenures of 17 years compared to nine years for savers in the private sector. K-12 savers have the longest tenure across government segments (23 years), and hospital/healthcare workers have the shortest (10 years).

Saving and engagement

Financial stressors abound

Aggregate employment numbers and slowing inflation paint a positive macroeconomic picture, but state and local job levels were still struggling to match pre-pandemic levels.1 Overall, many Americans remain concerned about their personal financial situations. Most public sector workers (85%) say inflation and the rising cost of goods is contributing to their financial stress, according to Empower research on the state of Financial Happiness. Not being able to save enough for retirement and not being able to retire are also adding to the financial stress of more than six in 10 surveyed government workers.2

Steady wins the race

Public sector workers are saving on average 6.4% of their income as of the end of 2023. By comparison, private sector workers are saving more (7.8%), but few are covered by defined plans, unlike the majority of government employees.

Despite inflation and other financial stressors, savings rates fluctuated little throughout the year. Average account balances benefited from positive market returns and increased by 12% from the prior year, closing out 2023 at $52,000.

Given a growing state and local government workforce, steady savings rates are a positive development as our research finds that younger and new employees tend to have lower savings rates.

Exploring the gender retirement savings gap

Women account for more than half of public sector savers, but their representation varies across income segments. Women are overrepresented in lower-income positions: 36% of women earn less than $60,000, compared with 28% of men. The reverse is true for higher income positions: Only 7% of women earn more than $120,000, compared with 10% of men. Women’s average savings rates in the public sector are 10% less than men’s (5% less in the private sector). They have an average account balance of $44,000, which trails men’s average account balance of $62,000 by 41%.

However, it’s important to note that the savings gap is less pronounced as income levels increase. Women making more than $120,000 have higher savings rates than men, and their average account balances are only 12% less than men’s in that income category.

Understanding these and other factors identified in the research can help improve women’s financial outcomes.

Increasing loans and hardship withdrawals

Debt — and getting out of it — is on the minds of many public sector workers. Paying off debt was the most common financial goal cited by 38% of surveyed government employees, followed closely by saving for retirement (37%).2

In 2020, loans and hardship withdrawals likely declined due to the Coronavirus Aid, Relief, and Economic Security (CARES) Act provisions and government stimulus. Since then, loans and hardship withdrawals have steadily increased. In 2023, approximately 4.1% of active public sector savers took out a loan, and 0.8% of active savers took a hardship withdrawal.

Although the proportion of savers taking out loans in 2023 increased, the growth rate of new loans decreased. However, hardship withdrawals increased by 58% — significantly more than the prior year. When compared to the private sector, new loans and hardship withdrawal rates are significantly lower.

Loans and hardship withdrawals by the numbers

- 7% of public sector savers have an outstanding loan, compared with 15% of private sector workers.

- More than 10% of Gen Xers have an outstanding loan, compared with less than 1% of Gen Zers.

- The average new hardship withdrawal amount is $6,899.

- The average new loan amount is $10,938.

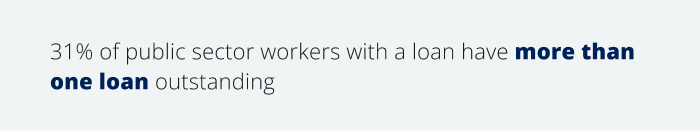

- 31% of public sector workers with a loan have more than one loan outstanding.

Public sector segment analysis

There are notable differences between government and private sector retirement plans, but there are also key differences between government segments. Public sector employees perform a wide variety of functions. They help administer and govern cities, work at hospitals, ensure our public utilities are up and running, and keep us healthy. Because public sector employee functions are so diverse, we wanted to better understand how these different groups were preparing for retirement.

Long tenures are the norm (mostly)

The average active public sector saver has a 17-year tenure compared to only nine years for active private sector savers. The prevalence of pensions in the government sector and commitment to public service likely contribute to the long tenures.

• Average tenures of active participants range from a low of 10 years (hospital/healthcare) to a high of 23 years (K-12).

• K-12 has the lowest proportion of Gen Z and millennial active participants (only 26%). Considering 23% of active K-12 savers are baby boomers, this could be a concern as teachers retire and more younger teachers are needed.

• The hospital/healthcare segment and public safety segments have some of the highest proportion of Gen Z savers, likely in part due to the need for new nurses and police officers to replace exiting workers in those segments.

Savings picture not uniform across segments

Key savings metrics vary significantly across segments. Intuitively, higher income savers are able to save more and have higher savings rates. Plan design also greatly influences average account balances depending on employer contributions (matching and non-matching), employee mandatory contributions, and available plan types. These factors help explain the very large average account balance and savings rate variations across public sector segments. Despite these aggregate segment trends, it’s important to note that plans within a segment may have very different retirement metrics due to the factors we just noted.

It’s also important to highlight a few things when looking at the hospital/healthcare segment. This segment is made up of public hospitals, which range from small community hospitals to larger county or city hospitals. Also included in this segment are other types of healthcare organizations, such as those focused on mental health or regional health districts. This means that the employee base is spread across a wide variety of functions, including nurses, doctors, administrators, maintenance staff, and other roles, and the retirement plan options available to those roles may vary.

- Workers employed by public utilities and water authorities have the highest average account balances and exceed the average account balance for private sector workers ($99,000).4

- State, K-12, and hospital/healthcare segments all have average balances below $50,000.

- K-12 savers have the highest savings rates (10.0%) while savers in state plans have the lowest rates (5.9%).

Loan and hardship withdrawal rates vary widely by segment

Most segments fall at or below the average government sector rates for new loans and hardship withdrawals. Transportation and county workers are the two highest outliers. Savers in those segments take out a significantly higher rate of loans — more than seven times greater than K-12 savers.

Public sector gender employment doesn’t split evenly across segments

The distribution of men and women can vary dramatically across government segments. As we noted earlier, women represent the majority of government workers, but some public sector segments remain skewed toward one gender.

Studying gender breakouts across segments is an important metric to help better understand what factors are driving gender income gaps and why women are saving less than men for retirement. These studies may help spark discussions and insights that could help employee recruitment, reduce income gaps, and improve retirement readiness shortfalls.

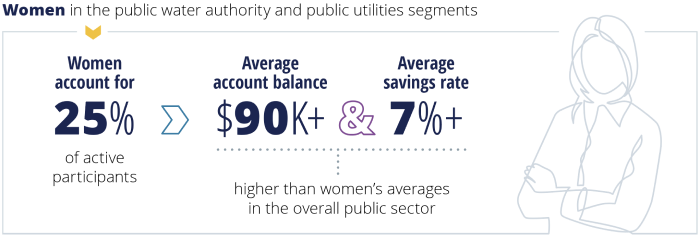

For example, exploring ways to improve the representation of women in public water authority and public utilities segments can expand the available talent pool while having a positive impact on women’s retirement readiness. Women in those two segments have average account balances higher than $90,000 and savings rates exceeding 7% — both higher than women’s averages in the overall public sector. However, women only account for a quarter of active participants in those segments.

Public safety workers prefer to do it themselves

Empower breaks out workplace savers’ investment strategies into two categories: professionally managed and do-it-yourself (DIY). Professionally managed strategies are a combination of participants utilizing one or two target date funds (at least a 95% allocation) or managed accounts. Those who are not enrolled in a professionally managed solution are classified as DIYers.

At an aggregate level, public sector savers are almost evenly split between using professionally managed (56%) and DIY (44%) investment strategies. Professionally managed strategies include managed accounts (MAs) and target date funds (TDFs). Most segments follow this distribution, but not all.

- Hospital/healthcare workers have the highest usage of professionally managed investment strategies (70%). The hospital/healthcare segment also has the greatest proportion of active savers with less than three years of tenure (32%). It also has the greatest proportion of Gen Z and millennial active savers. With lower tenure and younger ages, hospital employees are more likely to either be auto enrolled and invested in a TDF or select a TDF when they join the plan.

- On the opposite spectrum, 76% of public safety savers use a DIY approach.

Improving outcomes

Engagement is trending up

Engaged participants are more involved with their retirement plans and may be able to make more informed and timely planning decisions. However, many individuals wait to engage and get help. Almost half (49%) of surveyed public sector workers wish they had gotten advice earlier, and a third (34%) feel like they haven’t gotten the financial advice they need.2

Engagement continues to be a critical factor in helping employees pursue their financial freedom. We define and measure engagement as at least one interaction with Empower’s workplace savings site, mobile apps, Customer Care Center, or advisory services.

Engaged participants are saving more

There’s a strong correlation between engagement and savings rates: Engaged participants have savings rates 79% higher than unengaged participants. That relationship applies across all generations, but the savings differences increase with older generations.

An important aspect of driving engagement is better understanding employees and addressing their needs.

- Financial happiness roadblock: 17% of government workers feel that not getting the financial advice they need is one of the biggest roadblocks to trying to achieve financial happiness.2

- More advice: When asked about the financial topics they’re interested in learning more about, the top response was advice, followed closely by retirement planning.2

Investment strategy approaches vary by generation

As noted earlier, more than half of workplace savers use professionally managed strategies. Usage of these strategies is lower with older generations and peaks with millennials, who have a 69% utilization rate.

Saving and engagement metrics vary by type of investment strategy approach. Compared to TDF users, savers using managed accounts are saving 28% more, are more likely to be engaged (69% vs. 48%), and are more likely to contribute to the plan if they have a balance (80% vs. 77%).

A comprehensive financial picture for all

Account aggregation or the linking of accounts in one place provides individuals with a comprehensive view of their financial situation. A consolidated view can help people make more informed financial decisions.

Wanting a holistic view of their financial accounts isn’t just for individuals with large account balances. Public sector savers linking accounts are spread across all account sizes and ages, too. The overall distribution of active DC savers by generation is very similar to that of savers linking accounts.

People who are engaged, leverage financial wellness tools and resources, seek out advice, and link accounts save more than people who are not engaged.

And public sector savers who are linking more than two financial accounts to create a comprehensive view of their financial situation are saving 30% more than those taking advantage of financial wellness or advice resources.

Takeaways

Plan sponsor employees

- Acknowledge and address employee financial anxiety

Inflation is down, but financial stress remains. Work with your retirement provider and other benefits vendors to ensure you have a financial well-being platform that addresses relevant employee financial concerns and challenges. Consider enhancing your debt-management support given that paying down debt is the most cited financial goal by public sector workers. - Evaluate segment trends

Employee savings behaviors within and across public sector segments may vary significantly due to salary, tenure, gender representation, engagement, investment strategy, and other factors. Consider how these factors, plan design features, and plan offerings contribute to employee and plan retirement outcomes. - Consider offering advice and support to employees on their own terms

Public sector employees rank advice as the top financial topic they want to learn more about. Consider offering employees a variety of options to access the financial education and advisory services they are looking for.

Advice to offer public sector employees

- Know where you stand

Start with the basics by getting a comprehensive view of your financial assets and liabilities. Understanding where you stand is critical to making informed short- and long-term financial decisions. From there, you can set a budget, manage your daily finances, and plan for a secure retirement. - Don’t go it alone

Managing your finances and planning for retirement can be overwhelming. You can explore and take advantage of the different types of financial support available through your employer and retirement provider. You can choose how much help you want, starting with financial education to more comprehensive advisory services. - Take control of your finances

Make thoughtful savings and spending decisions. Consider maximizing your retirement savings based on your current financial situation and retirement goals. A financial plan can help you determine how to balance and optimize saving, spending, and paying down debt.

Methodology

Empower as recordkeeper

The objective of this analysis is to understand how participants behave and what drives that behavior, and, as a result, what insights and learnings can help American workers on their journey to a secure retirement. To accomplish this, we analyzed the data of 1.9 million active defined contribution participant accounts with balances greater than $0 from state and local governments.

This year’s study includes participant accounts from Empower’s past MassMutual acquisition but excludes participant accounts that belong to Empower’s recently completed acquisition of Prudential’s retirement business. Newly acquired plans from the Prudential acquisition will be included in future EAFJ studies once they have been on Empowerʼs recordkeeping platform for approximately 12 months. The study includes defined contribution plans, such as 401(k), 401(a), 403(b), and 457 plans from government institutions.

Data definitions

All data is as of December 31, 2023, for 1.9 million active government defined contribution plan participants with a balance greater than $0.

- Account linking or consolidation is the linking of multiple financial accounts that allows for the consolidated and comprehensive view of a participant’s financial situation.

- Active participants include participants with governmental defined contribution (DC) accounts having balances greater than $0 with the current employer. This excludes accounts of terminated and deceased participants and beneficiaries.

- Advice/guidance is defined as human advice provided through Empower advisor interactions, participants enrolled in managed accounts, and participants who use the Help Me Do It section of their plan’s website.

- DIY (do-it-yourself) participants are not enrolled in a professionally managed solution like a managed account or TDF.

- Eligibility is calculated based on the date at which participants become eligible to participate in the retirement plan.

- Engagement is defined as at least one interaction in a 12-month period between January 1, 2023, and December 31, 2023, through the participant website, mobile apps (Android™ or iOS®), Empower Customer Care Center, and Empower Retirement Solutions Group retirement plan advisors serviced by registered investment adviser representatives. This excludes IVR interactions, email, mail, on-site group sessions, individual sessions, and webinars. Engagement is calculated for all active participants.

- Gender break may not add up to 100% due to unavailability of gender information for some participants and limited reporting of participants identifying as nonbinary.

- Generational age breakouts – Silent Generation: born in or before 1945 – Baby boomers: born between 1946 and 1964 – Gen X: born between 1965 and 1982 – Millennials: born between 1983 and 1995 – Gen Z: born in 1996 or later

- Government defined contribution plans of state and local governments include 401(k), 401(a), 403(b), and 457 plans.

- Income represents compensation estimated for the full year. In cases where compensation information is missing, the calculations exclude those participants.

- Savings rate is the portion of compensation a participant has chosen to contribute to the retirement account expressed as a percentage of compensation. It is calculated for eligible participants who are saving in their DC accounts and have a balance greater than $0. It does not include employer match. If participant income was unavailable, it was excluded while calculating savings rate to give an accurate representation of data.

- Segment analysis is based on available plan-level information. Public sector plans were categorized under one of the 10 segments we defined based on the functional role of the government entity.

- Silent Generation data is not shown separately but included in the total.

- TDF (target date fund) users are only those participants who have 95% of their investment allocation invested in one or two target date funds.

- Tenure is calculated based on the employment date.

- Values for each quarter are standalone, representing eligible participants with a balance greater than $0 in that quarter.

1 The Urban-Brookings Tax Policy Center, “State and Local Government Jobs Still Haven’t Recovered from the Pandemic,” August 9, 2023.

2 Empower, Financial Happiness, 2023.

3 Empower, Women at work: How women in government are building careers – and building futures, 2023.

4 Empower analysis of 6.1 million active corporate 401(k) participants with a balance as of 12/31/2023.

Securities, when presented, are offered and/or distributed by Empower Financial Services, Inc., Member FINRA/SIPC. EFSI is an affiliate of Empower Retirement, LLC; Empower Funds, Inc.; and registered investment adviser Empower Advisory Group, LLC. This material is for informational purposes only and is not intended to provide investment, legal, or tax recommendations or advice.

Investing involves risk, including possible loss of principal. If discussed, past performance is not a guarantee of future results.

Online advice and the managed account service are part of the Empower Advisory Services suite of services offered by Empower Advisory Group, LLC, a registered investment adviser. Past performance is not indicative of future returns. You may lose money.

Risks associated with investment options can vary significantly, and the relative risks of investment categories may change under certain economic conditions.

The research, views, and opinions contained in these materials are intended to be educational; may not be suitable for all investors; and are not tax, legal, accounting, or investment advice.

Empower and its affiliates are not providing impartial investment advice in a fiduciary capacity to the plan with respect to this material. The plan fiduciaries are solely responsible for the selection and monitoring of the planʼs investment options and for determining the reasonableness of all plan fees and expenses.

Android, Google Play, and the Google Play logo are trademarks of Google LLC.

iOS is a registered trademark of Cisco in the U.S. and other countries and is used under license.

On April 1, 2022, Empower Annuity Insurance Company of America, an affiliate of Empower Retirement, LLC (Empower), acquired the retirement services business of Prudential Financial, Inc. (Prudential). EAICA acquired Prudential’s retirement services businesses with both a share purchase and a reinsurance transaction. EAICA acquired the shares of Empower Annuity Insurance Company (formerly Prudential Retirement Insurance and Annuity Company), and business written by The Prudential Insurance Company of America was reinsured by EAICA and Empower Life & Annuity Insurance Company of America of New York (for New York business).

Following an initial transition period, EAICA will become the sole administrator of this business. Empower refers to the products and services offered by EAICA and its subsidiaries, including Empower Retirement, LLC.

Empower is not affiliated with Prudential or its affiliates.

On August 1, 2022, Empower announced that it is changing the names of various companies within its corporate group to align the names with the Empower brand. For more information regarding the name changes, please visit empower.com/name-change.

“EMPOWER” and all associated logos and product names are trademarks of Empower Annuity Insurance Company of America. ©2024 Empower Annuity Insurance Company of America. All rights reserved. GEN-ART-WF-3222255-0324 RO3431738-0324

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.