The Ticket

The Ticket

New Empower research explores the ways that personal finance and politics are linked.

New Empower research explores the ways that personal finance and politics are linked.

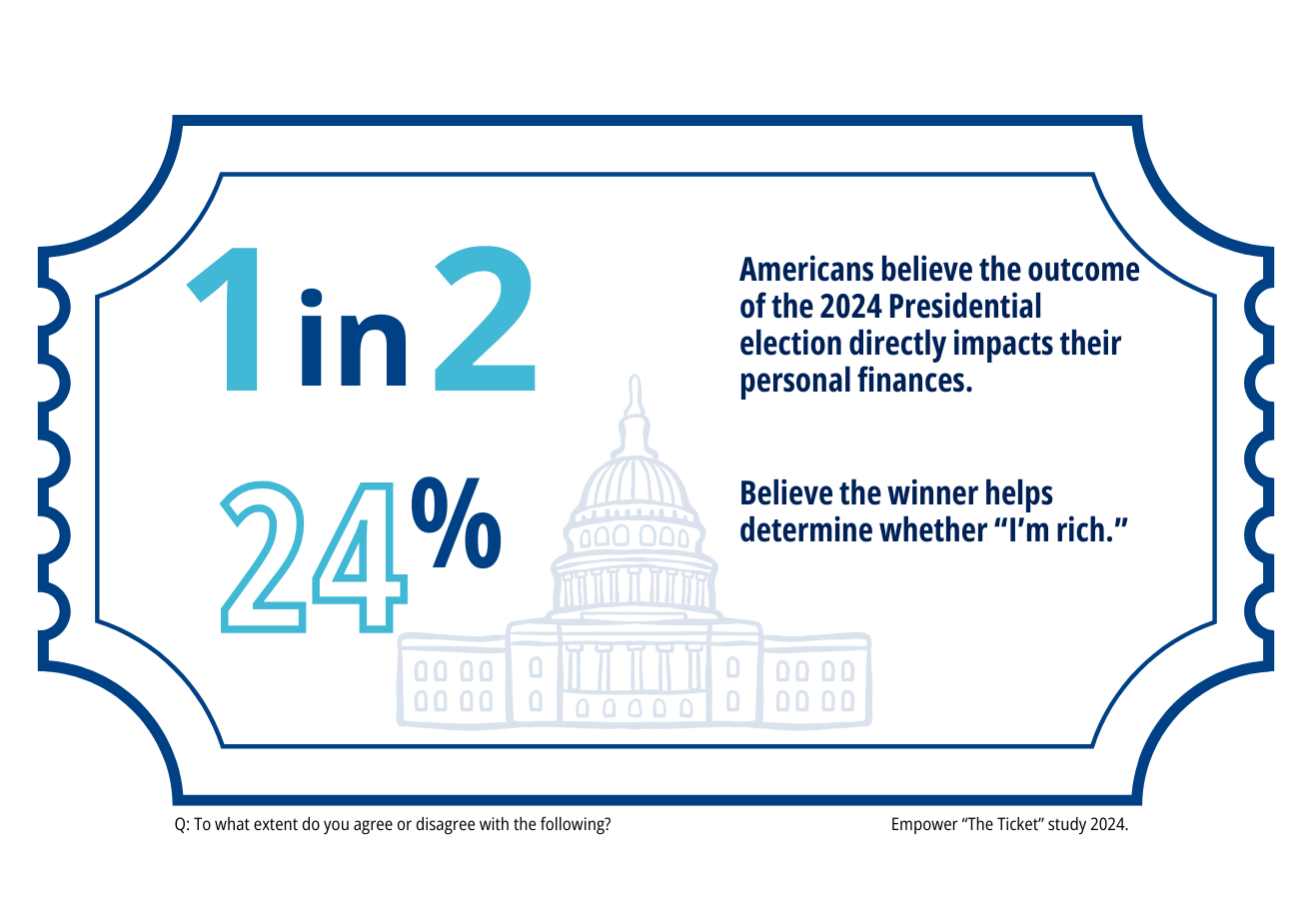

Beyond the U.S. economy, one in two Americans believe the outcome of the 2024 Presidential election will directly impact their own personal finances. In fact, a quarter (24%) say that the winner of the election helps determine “whether I’m rich or not” – a belief more firmly held by the Middle Class – reaching 27% for those with an income $50-$100k, compared to 22% for those making under $50k; and 23% for people with incomes greater than $100k.

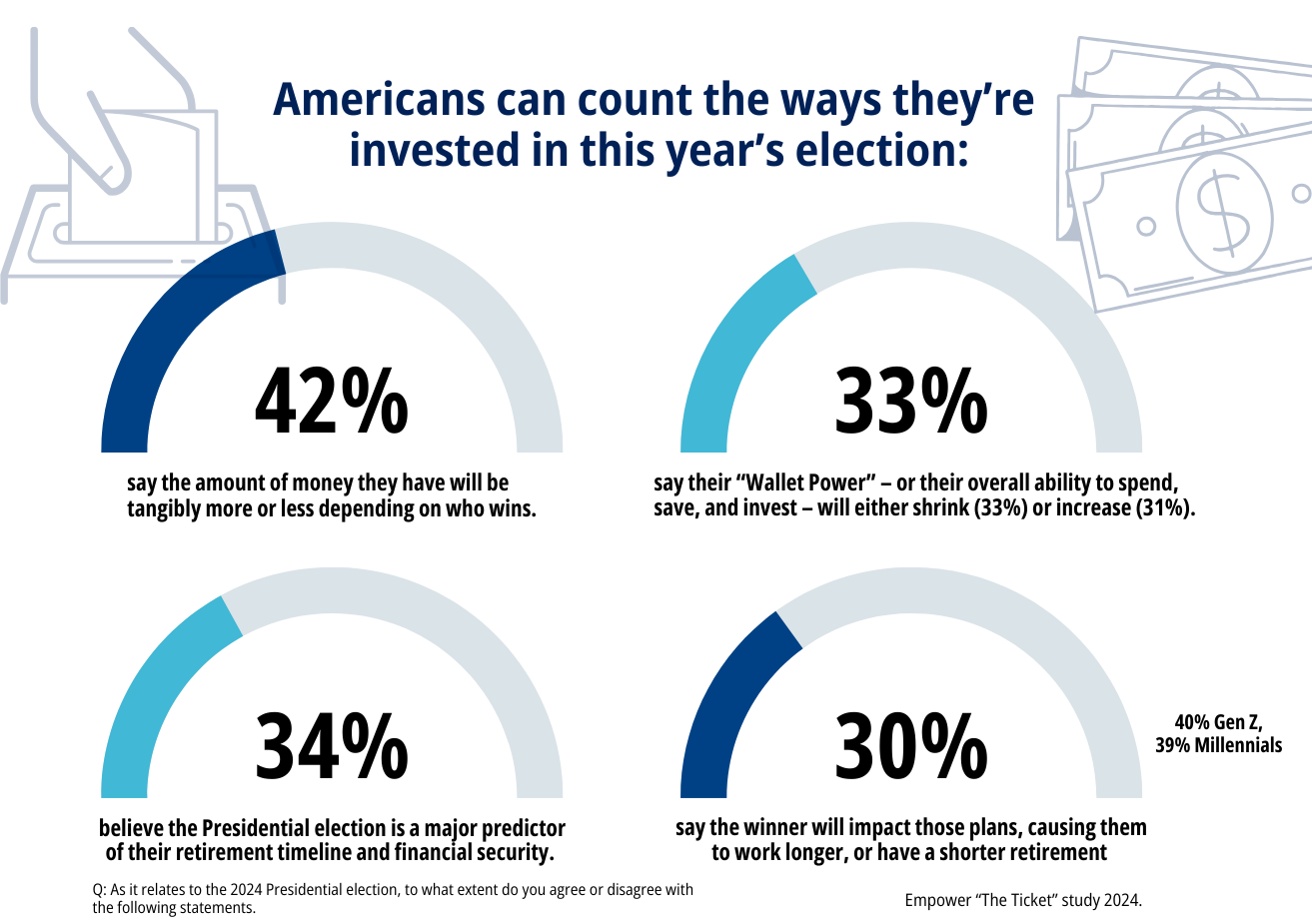

Americans can count the ways they’re invested in this year’s election, with 42% saying the amount of money they have will be tangibly more or less depending on who wins. One third (33%) say their “Wallet Power” – or their overall ability to spend, save, and invest – will either shrink (33%) or increase (31%). More than a third (34%) believe the Presidential election is a major predictor of their retirement timeline and financial security, with 30% saying the winner will impact those plans, causing them to work longer, or have a shorter retirement (40% Gen Z, 39% Millennials).

“The adage is that ‘all politics is local’—and when it comes to money, it hits very close to home, with many Americans seeing a direct link between their own prosperity and the highest office in the land. From their retirement timeline to their account balances, people feel there is a lot riding on the outcome of the election in terms of their own financial happiness."

Chief among the issues at stake, many Americans (42%) believe the winner of the Presidential election will get inflation and prices under control, making things more affordable (47% men, 38% women) at a time when many Americans say they’re feeling “The Big Shrink.” One third (33%) say the winner of the Presidential election will make it easier to reach their personal financial goals, such as the 33% who say the victor will make it more affordable to buy a home (42% Millennials).

The money moves on the ballot

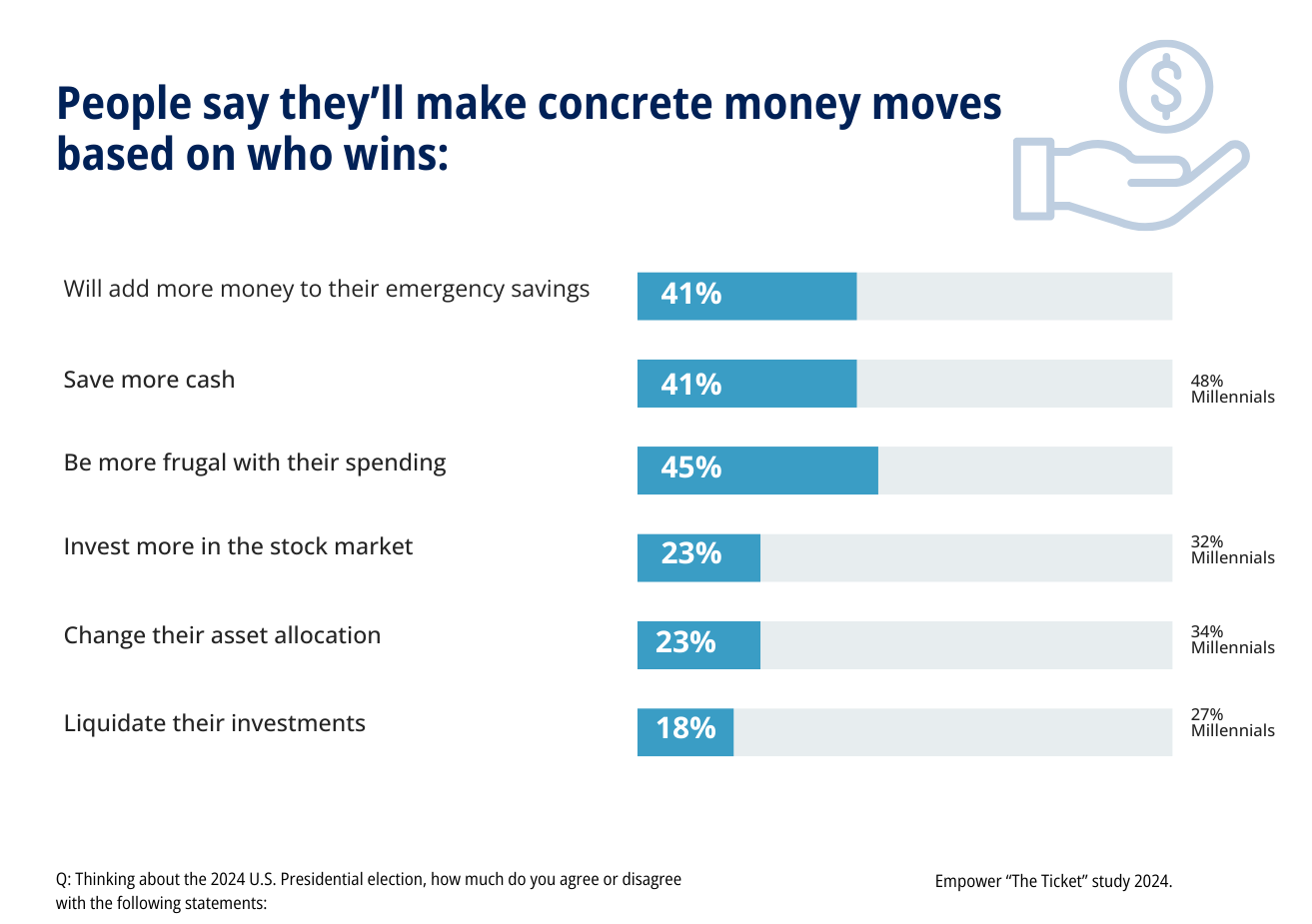

People say they’ll make concrete money moves based on who wins: 41% will add more money to their emergency savings, save more cash (41% overall, 48% Millennials), and be more frugal with their spending (45%).

More Americans say they are closely following the 2024 Presidential race than the stock market (67% vs. 33%), and half (53%) agree that uncertainty about the outcome of the Presidential election impacts the markets. One in four (23%) will invest more in the stock market based on the outcome of the Presidential election (32% Millennials) or change their asset allocation (34% Millennials). Nearly 1 in 5 (18%) plan to take more drastic measures, and say they will withdraw their money/liquidate their investments (27% Millennials).

More findings:

- It’s a tie for the economy: People are split on which direction the economy will turn based on the outcome of the election: 30% predict an economic recession, while 32% say it will cause an economic boom. Still, a majority (67%) are worried about the state of the economy depending on who wins the Presidential election.

- The jobs report: 57% say the job market will be affected by the winner of the Presidential election, though 29% say they are worried about job security regardless of the outcome.

- Who wants to talk politics…at work?: 33% feel more comfortable asking for a raise at work than talking politics with their coworkers. Still, in general, people would rather talk politics (53%) than about their own personal finances 35%.

- Bonus round: 31% say the winner of the Presidential election will affect their employer’s/company’s financial performance, and 22% think the winner of the Presidential election will affect their work bonus (33% of Millennials).

- Clocking in: Nearly 1 in 5 (19%) admit they’ll be less productive at work during the Presidential election (29% Gen Z, 27% Millennials). A third will take time off from work on election day to vote (41% Millennials) and will spend a large amount of time watching the Presidential election proceedings at work (34% overall, 42% Millennials).

- Retirement ready or not: Inflation and rising prices (45%), the state of the economy (37%), and access to a retirement plan (23%) are top factors people say influence their ability to retire on time and securely, which is one reason they remain core issues in the election. Still, voters are mixed about how the 2024 Presidential election will affect their retirement: 26% say they will never be able to retire; 29% overall say they’ll have more money in retirement (35% men, 24% women; 38% Millennials). Thinking about the 2024 election results, many remain optimistic about the future: 31% overall say they’ll likely be more financially secure in retirement.

ABOUT THE STUDY

Empower’s “The Ticket: Money and Politics” study is based on online survey responses from 2,200 Americans ages 18+ fielded by Morning Consult between July 22-24, 2024. The survey is weighted to be nationally representative of U.S. adults (aged 18+).

Get financially happy

Put your money to work for life and play

RO3876279-0924

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.