🕗 Time is money

Time is money, and there’s a premium: Americans say their time is worth $240 per hour, on average, according to new research from Empower.

Based on a standard 40-hour workweek, that puts the perceived value at $499,200 per year – nearly eight times higher than the average U.S. salary of $59,384.

For many people, it’s a race against the clock: Half feel they're running out of time to save for retirement, and 43% wish they could go back in time to start saving sooner, though Empower Personal Dashboard™ data shows people may be further along than they think. The average 401(k) balance clocks in at $291,810 and for those in their 50s approaching retirement age, the number jumps to $580,259 – one key measure of overall personal savings and investments.

Check out the study, and let’s dive into other signs of the time in this week’s money news.

— The Editors

Money

💸 That’s so 2014: Nearly a decade ago, two batches of $1 bills* were printed in 2014 and 2016 with a specific error and went into circulation in New York and Washington D.C., for a total of 6.4 million banknotes. Under the right condition and matching serial number, currency collectors are willing to pay between $20,000 and $150,000 for a pair from these batches. Only nine of these extremely rare pairs have been matched, leaving millions of these special $1 bills out there.

⚡ 24/7 trading: The New York Stock Exchange is polling market participants about the merits of trading stocks round the clock,* expanding beyond the opening and closing bells for all Americans. The survey comes as startup 24 Exchange, which secured a $14 million* investment from Point72 Ventures and others, is seeking SEC approval to bring the non-stop nature of crypto trading to the stock market. Compounding gains can play an essential role in building wealth, and 3 in 10 people say they would have invested in a popular stock if they could go back in time, according to Empower research.

🔮 The future is now: After seeing a convincing AI-generated video of himself, the Oracle of Omaha, billionaire Warren Buffett, predicted* at his annual meeting that AI – and related fakes – could become “the growth industry of all time.” The generative AI market is expected to reach $1.3 trillion* by 2032, and rising demand for products could add to the mix: 21% would use AI to recommend money moves to plan for retirement.

🐣 First up, the chicken or the egg? America’s love for chickens is taking flight, helping Tractor Supply rule the roost with $30 billion* in revenue. Chicks themselves cost $3 or $4, and last year the company sold 11 million of them – more than double the number sold 10 years ago. Among the company’s 34 million customers enrolled in its loyalty program, 1 in 5 owns chickens. One recent study found that 13% of U.S. households now own a collective 85 million backyard chickens. The benefit of fresh eggs is a boon, as the price of eggs rose 4.6%* month-over-month in March.

Life

The 10,000-year clock

Tick-tock for an eternity? The time is now, according to Jeff Bezos, who has invested $42 million* to construct the 10,000-Year Clock, a mechanical wonder that uses the Earth’s thermal cycles to power itself inside a mountain in West Texas.

Leveraging a solar synchronizer, a pendulum, a chime generator, and a series of gears and dials, the 500-foot-tall clock is designed to synchronize with the sun every noon and keep track of the years, centuries and millenniums. Once built, the clock will have limited viewings for the public and will take a day’s hike to reach. Bezos’ project aims to leave a lasting legacy for humanity.

Time is of the essence, as Americans work toward their own money milestones: 78% of Americans say it’s never too late to start focusing on your finances. For many, getting advice early on is key: Nearly 1 in 5 would have worked with a financial professional sooner.

Play

Pretty fast: lab-grown diamonds with sparkly profits

Pandora, the world’s largest jewelry maker, reported shiny first quarter sales up 18% YTD,* crediting a surge in popularity for lab-grown diamonds. Sales of these stones jumped 87% year-over-year for the brand, while the global industry hit $12 billion in sales in 2022. The Copenhagen-based jewelry brand started doubling down on lab-grown diamonds and expanded its collections last year.

Natural diamonds form under tremendous pressure and heat over millions of years, so scientific breakthroughs that replicate the process in mere weeks is “pretty” disruptive – particularly as the lab-grown sparklers are chemically (and visually) indistinguishable.

Nearly 2 in 5 people say saving time is more important than saving money (37%) – with these innovations, some companies and consumers may have the best of both worlds. The price gap between a 1-carat lab-grown diamond and its natural counterpart widened from 10% in 2016 to as much as 80% by 2022.

Spending time wisely: Americans know time is precious,* and many are willing to spend money to get a little more or achieve a happier life, like the 40% who say they’d rather pay to make life easier right now than to save and have more money later. Though, the price of 60 minutes varies: 1 in 4 Millennials value their time at over $500 per hour – the highest of any generation (just 6% of Boomers name that rate).

Work

All the time in the world

The share of workers taking a sabbatical (those taking off for three weeks or more) rose from 3.3%* in January 2019 to 6.7% in January this year. One such trend is taking off: Dubbed “family gap years,” parents are prioritizing travel to spend time with their children and teach them about the world.

Millennial and Gen X parents are embarking on sight-seeing sabbaticals (some upwards of $100,000*), taking time off work with their children in tow. While on the road, families combine homeschooling with worldschooling, which prioritizes immersive travel as education.

Travel agencies are now specializing in the trade, offering family gap year and extended travel planning services for $80 to $100 an hour, with commissions from booking hotels and experiences.

For some, it’s a priceless endeavor: Recent Empower research reveals 63% of people “feel wealthy” if they have enough time to spend with family and friends.

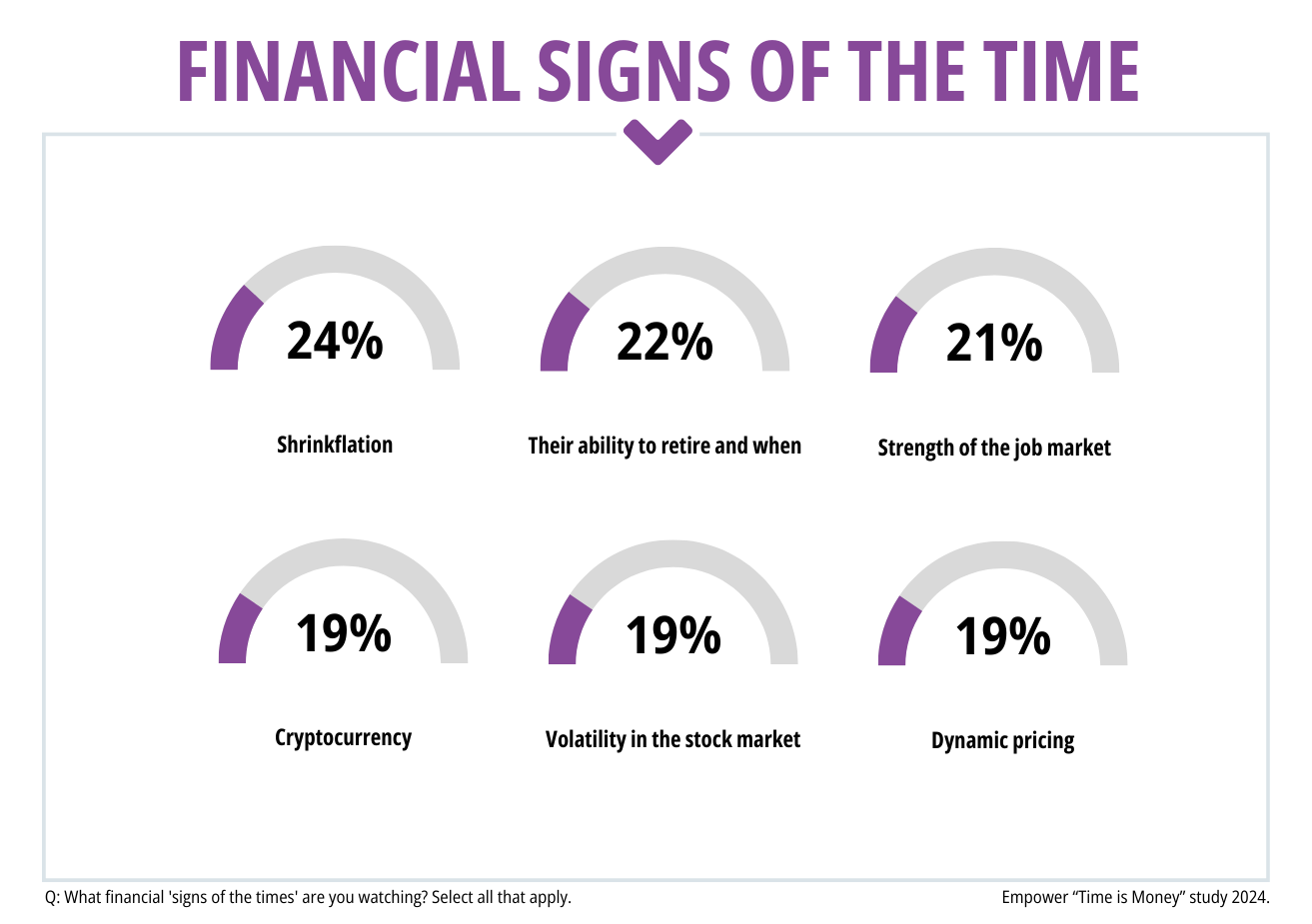

Here are the financial “signs of the time” people said they’re watching this year.

Get financially happy

Put your money to work for life and play

As of May 8, 2024, EAG does not hold shares of Pandora (PNDORA.CO) or Tractor Supply Company (TSCO) in advisory client accounts.

*Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness, or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement, responsibility, or approval by Empower of the contents on such third-party websites.

RO3561863-0524 WF3355112-0524

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.