Time is Money

Time is Money

It's a race against the clock: New Empower research unveils how Americans value their time in pursuit of financial goals and retirement – and what it's worth to achieve the good life.

It's a race against the clock: New Empower research unveils how Americans value their time in pursuit of financial goals and retirement – and what it's worth to achieve the good life.

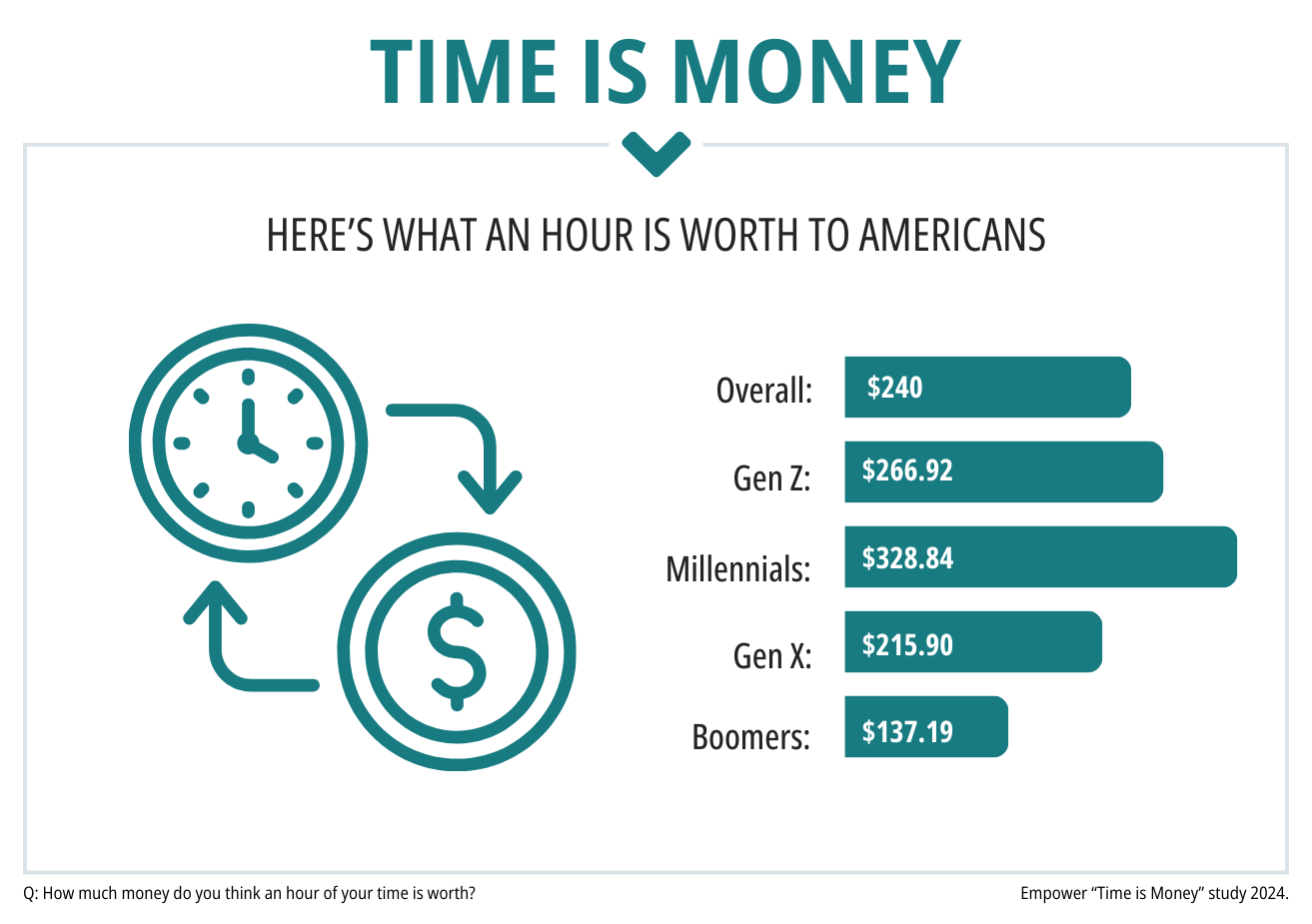

Time is money, and there’s a premium: Americans say their time is worth $240 per hour, on average, according to new research from Empower, a leader in financial planning,1 investing, and advice. Based on a standard 40-hour week, that puts the perceived value at $499,200 per year – nearly eight times higher than the average U.S. salary of $59,384.2 One third of people set the price at under $50 per hour, though 1 in 4 Millennials value their time at over $500 per hour – the highest of any generation (just 6% of Boomers name that rate).

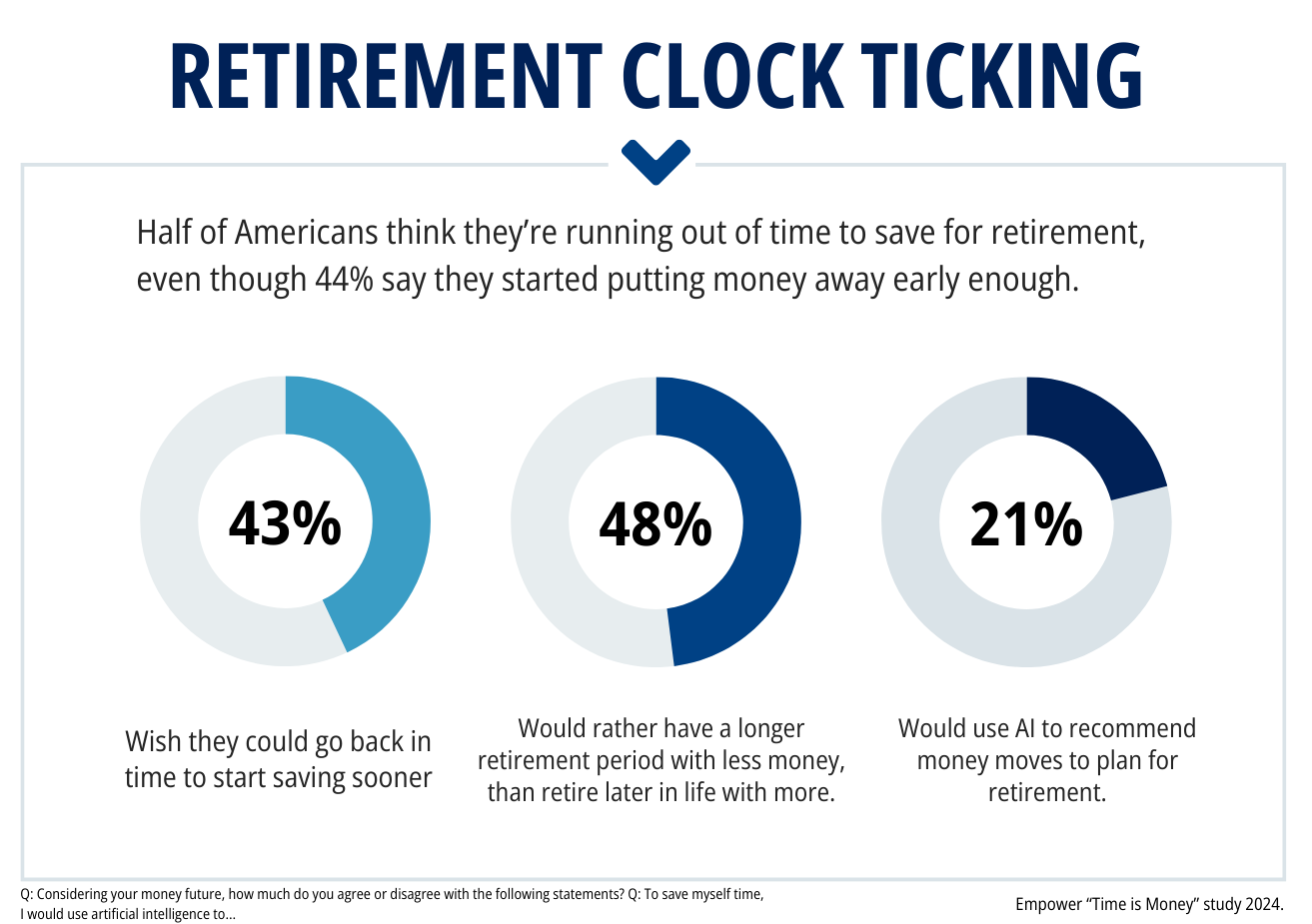

Many Americans are racing against the clock when it comes to financial goals: half think they’re running out of time to save for retirement, even though 44% say they started putting money away early enough. Another 43% wish they could go back in time to start saving sooner, and half (48%) would rather have a longer retirement period with less money, than retire later in life with more.

People may be further along than they think. According to Empower Personal Dashboard™ data, the average 401(k) balance clocks in at $291,810 and for people in their 50s approaching retirement age, the number jumps to $580,2593 – one key measure of overall personal savings and investments.

"Against an uncertain economic backdrop, time is a precious commodity -- whether it's the way people value their hours to earn a living, or the price we pay to free up time in the here and now. Money is more than a math problem, and the study suggests a complex calculation of what it’ll take to achieve goals like a secure and timely retirement," says Rebecca Rickert, head of communications at Empower. “It's a race to find financial happiness, all around."

Additional key findings:

- Spending time wisely: The average price of 60 minutes varies: Millennials say it’s worth $328.84 per hour, followed by Gen Z at $266.92, Gen X at $215.90 and Boomers at $137.19. Based on this study’s findings of how Americans value their time, two hours of meetings at work cost close to $500 per person; catching nightly Z’s costs nearly $2,000 a day (or close to $60,000 a month).

- Less is more: 1 in 4 people (26%) are willing to take a 15% pay cut to gain more free time. 40% would rather pay to make life easier right now than to save and have more money later and more than 2 in 5 say outsourcing household tasks gives them a better work/life balance (41%).

- Cost of convenience: 36% would rather pay more to get an item delivered instead of driving 10 minutes to get it. A third of Gen Z (30%) would pay up to $5,000 per year to save time not doing everyday tasks like cleaning and yard work, and 36% of Millennials would shell out up to $10,000 for someone to take on in-house chores and cook meals.

- AI to save time: 21% would use AI to recommend money moves to plan for retirement, help pay bills on time (25%) and make a budget by examining personal financial accounts (23%).

- Time on money: 26% would spend $5,000 per year to have someone else manage their long-term financials, investments, and savings. More than a third of Americans admit to procrastinating money tasks like paying their bills.

- Clocking in: 44% say they wish they could work part-time, but can’t afford it. More than a third (32%) say they want to start their own business, but don’t have the time.

- The luxury of time: 6 in 10 people (63%) “feel wealthy” if they have enough time to spend with family and friends. Nearly a third feel comfortable taking on debt if it buys more free time (29%) or a memorable experience (29%). Nearly 2 in 5 say saving time is more important than saving money (37%).

Sign of the times

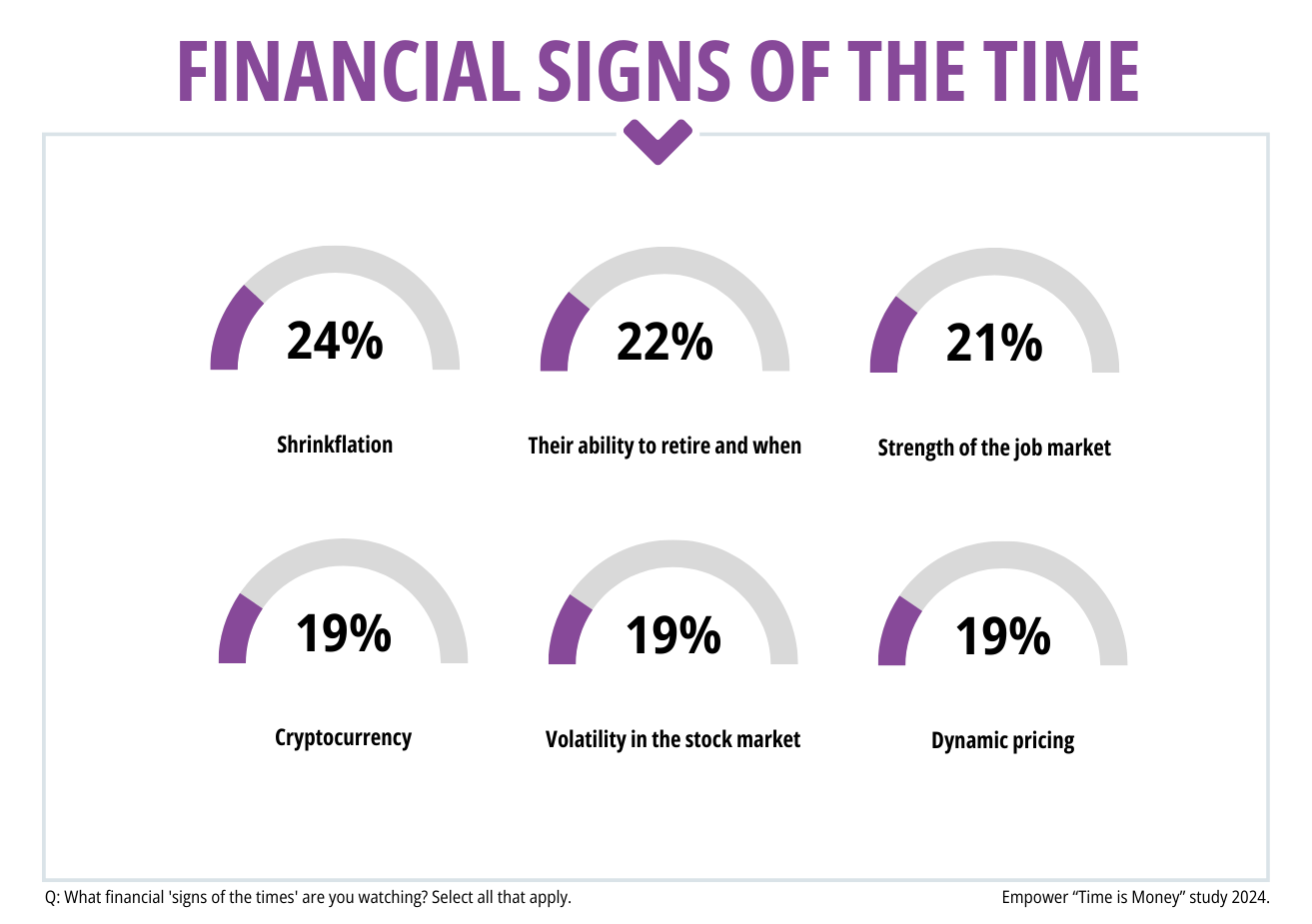

Americans are having to work alongside the wider economy on their journey to hit their goals. Though 30% of adults are not keeping track of any financial “signs of the times,” around a quarter are keeping an eye on shrinkflation (24%), as product sizes get smaller for the same or more cost. It can be a struggle, as more than 3 in 4 Americans believe they’re doing as much as they can to save money while shopping (76%). Some 22% of Americans are also keeping track of their ability to retire and when (22%), as nearly half (48%) worry about how they’ll pay for expenses once they’re no longer working.

Americans are watching the strength of the job market (21%), and cryptocurrency (19%). The same amount are keeping an eye on volatility in the stock market. Compounding gains can play an essential role in building wealth and 3 in 10 people say they would have invested in a popular stock if they could go back in time.

The time is now

Time is of the essence as people work toward streamlining their lives and focusing on what matters most to them, amid commitments across work and home that can affect their financial happiness. More than half of Millennials (52%) and 37% overall think saving time is more important than saving money.

For many, getting advice early on is key: nearly 1 in 5 would have worked with a financial professional sooner. Overall, Americans remain optimistic, with 78% saying it’s never too late to start focusing on your finances.

*ABOUT THE STUDY

The Empower “Time is Money” study is based on online survey responses from 2,204 Americans ages 18+ fielded by Morning Consult from March 11-14, 2024. The survey is weighted to be nationally representative on the following dimensions: age, gender, education, race and region. Results from the survey have a margin of error between +/- 2%.

Get financially happy

Put your money to work for life and play

1 Empower Advisory Group, LLC, a registered investment adviser, provides financial planning services using the MoneyGuidePro tool. MoneyGuidePro is not affiliated with Empower Retirement, LLC and its affiliates. Empower Retirement, LLC and its affiliates are not responsible for the third-party content provided.

2 U.S. Bureau of Labor Statistics Dec 2023. Quarterly Census of Employment and Wages.

3 Anonymized user data from the Empower Personal Dashboard™ as of March 2024.

RO3510881-0424

Explore more

Visualize the data >>

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.