Gifted

Gifted

Americans plan to spend an average of $1,400 this holiday season, while 42% will regift to save money

New Empower research explores how people are “spending” the holidays

Americans plan to spend an average of $1,400 this holiday season, while 42% will regift to save money

New Empower research explores how people are “spending” the holidays

Key takeaways

- 84% of Americans report there is at least one topic they’d want to avoid at the holiday dinner table this year; politics (57%) and financial topics like how much money they have (51%), spend (44%), or make (33%)

- More than half (55%) hope they don’t get asked to host a holiday party this year due to costs; 42% feel pressured to attend holiday events that are outside their budget

- 51% of Americans don’t know the "right,” or etiquette-appropriate amount to spend on gifts for everyone on their list this year; 56% are reluctant to arrange a gift-giving budget with family and friends

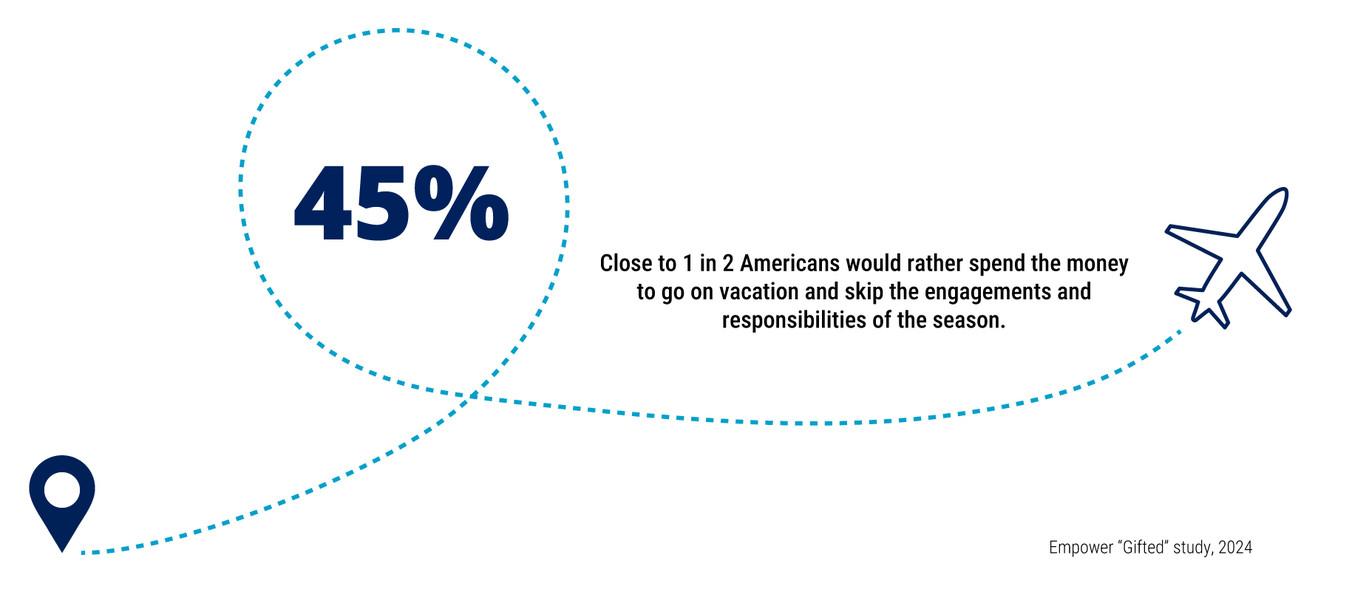

- Nearly half (45%) admit they’d rather spend their money to go on vacation and skip the holidays; 1 in 4 (27%) or nearly 67 million Americans plan to skip Thanksgiving this year to save money

- The perfect gift doesn’t exist — actually, 60% agree it’s cash for the holidays

- 37% admit they spend more on gifts than intended during the holidays trying to impress others

- 42% of people regift to save money during the holidays

FA-LA-LA finances and spending stressors

Nearly half of Americans are worried about money (49%) this season, from the festivities to their financial obligations: In fact, a third (32%) feel the stress over their holiday spending will be more than last year while half (48%) anticipate that their financial concerns will take away from their holiday joy.

More than half are concerned about being able to afford gifts for everyone on their list (59%),1 finding the best deals (51%) and being able to pay their bills on time (54%). Still, over 2 in 5 are worried about having a money conversation around setting a gift-giving budget with family and friends (45%). Finding the trendy “it” gift this year is a stressor for 36% of shoppers.

Social obligations and hosting can be taxing on the wallet, leaving many wanting to avoid these situations altogether: Half of Americans (55%) hope they don’t get asked to host a holiday party this year because of the associated costs, while 42% admit to feeling pressured to attend holiday events that are outside their budget.

Nearly half (45%) admit they’d rather spend the money to go on vacation and skip the engagements and responsibilities of the season.

‘Tis the season to spend

A third of Americans (34%) don’t think their money will stretch as far this holiday season as it did last year, and 4 in 5 (83%) report their holiday spending will be impacted by economic pressures like inflation (62%) and cost of living increases (59%). About 1 in 3 think their current debt (35%) and uncertainty about the economy (34%) will play into how they’re spending this holiday season. Despite these concerns, Americans intend to spend more money this year on the holidays:

Expense | Spend more | Spend less |

Gifts | 34% | 26% |

Holiday dinner menu | 28% | 25% |

Holiday travel | 24% | 29% |

Decor | 20% | 35% |

While the majority (80%) set a holiday spending budget, people are nearly 3.5x more likely to overspend than come in under their budget (45% vs. 13%). Even though half (48%) say they plan ahead by being more frugal most of the year, to afford the holiday splurge, they still overspend. Close to 2 in 5 (37%) Americans admit they spend more on gifts than intended during the holidays trying to impress others. More than half (53%) would rather take on debt than give up celebrating the holidays in a special way, and 1 in 4 (26%) expect to take on more debt this holiday season than last.

Rather than cross people off their gift lists (1 in 5 gift-givers will do this) or curtail their spending, 9 in 10 (89%) are finding ways to save money on presents this year, including:

- Consider only buying items that are on sale (50%)

- Set price limits with loved ones (46%)

- Only give one gift per person on their list (38%)

Others say they’re more likely to shop for sales and deals on Black Friday and Cyber Monday (37%) and buy less expensive (33%) or fewer (25%) gifts this year than they were last year. More than 2 in 5 (42%) regift to save money during the holidays.

Some people say they’ll make some lifestyle tweaks to help save up for the festivities, including:

- Make food at home instead of eating out (57%)

- Cut back their spending in other areas to put towards gifts and holiday entertainment (49%)

- Dip into their savings accounts to pay for gifts (32%)

- Cancel subscriptions to services like premium channels and streaming platforms (25%)

Holiday spending by the numbers

Giving season

More than half of people (57%) say if they were to receive a $5,000 windfall right before the holidays, they would spend it on gifts. Americans plan to shell out hundreds of dollars across presents, travel, and socializing this year.

On average they’ll spend more than $1,430 during the season:

- $766.50 on holiday gifts

- $424.80 on holiday travel

- $239.08 on holiday meals and parties

One third of Americans plan to buy themselves a gift this holiday season, spending $241.91, on average. When it comes to others on their gift lists, Americans plan to spend:

- $473.71 on kids

- $322.47 on a spouse/partner

- $179.03 on parent(s)

- $148.95 on a boss

- $116.50 on colleagues

- $74.85 on pets

Here's who will make it onto the list:

- 92% will buy for their kids

- 83% will buy for their spouse

- 59% will buy for their parent(s)

- 41% will buy for their pets, averaging

- 37% will buy for their colleagues

- 30% will buy for their boss

Gift-giving etiquette

Half of Americans (51%) admit they don’t know the right or etiquette-appropriate amount to gift each person on their list; yet more than half (56%) feel uncomfortable asking others about setting a holiday gift-giving budget, even though it would help create a “worry-free” holiday.

Others (43%) feel uncomfortable buying gifts for people on their list who they think have more money than they do.

The gift of cash

Three in 5 (60%) Americans agree that the perfect holiday gift is cold, hard cash. While close to 7 in 10 (68%) prefer money or gift cards over a gift someone selects for them, cash reigns supreme:

- 63% think gifting money is better than giving someone a gift card

- 77% feel receiving money saves them time from returning items they don’t like

- 84% think gifting money saves them time shopping for items for the people on their lists

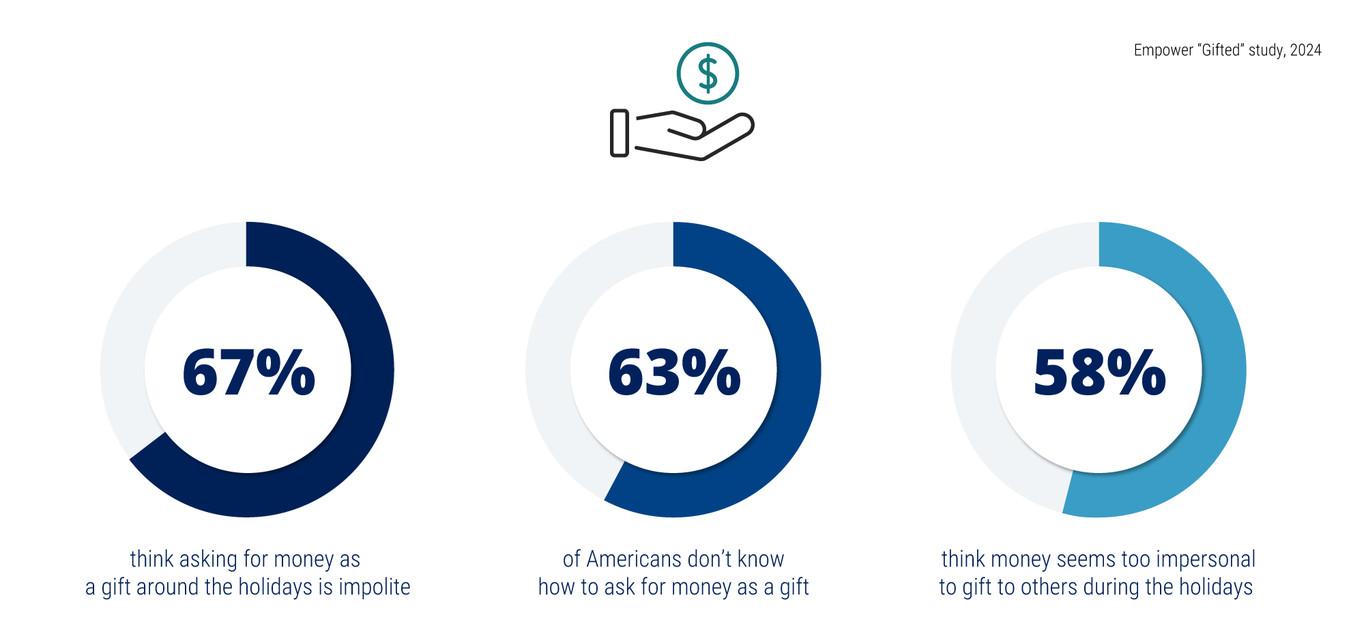

While gifting money is a great option, some people hesitate to put it on the wish list:

- 67% think asking for money as a gift around the holidays is impolite

- Some 63% of Americans don’t know how to ask for money as a gift, even though it’s the gift they want or need the most

- And while convenient, close to 3 in 5 (58%) think money seems too impersonal to gift others during the holidays

Hosting for the holidays and off-the-table topics

One in 4 (27%) or nearly 67 million Americans plan to skip Thanksgiving this year to save money. Among people worried about the holidays, 14% are concerned about affording a Thanksgiving turkey. According to the Consumer Price Index, the cost of turkey (and some other uncooked poultry) is down 2.24% versus last year.2

Nearly a third (28%) of Americans will spend more money on the holiday dinner menu than they did last year. This is likely why 1 in 5 (20%) are asking their guests to contribute something to the holiday dinner. Others don’t plan on hosting a holiday dinner at their house this year like they did last year (16%).

While the majority of Americans (87%) agree that spending time with family during the winter holidays is priceless, 84% of Americans report there is at least one topic they’d want to avoid at the holiday dinner table this year. More than half (57%) want to skip talking about politics altogether. Others want to avoid financial topics like how much money they have (51%), spend (44%), or make (33%).

Many people say they can do without the unsolicited advice from around the table (39%), and those “keeping up with the Joneses” conversations (34%).

Methodology:

The Empower “Gifted” study is based on online survey responses from 2,000 nationally representative Americans aged 18+ fielded by Wired Research from October 8 through October 21, 2024. Quotas are set using U.S. Census to ensure a nationally representative sample of U.S. adults (aged 18+).

Get financially happy

Put your money to work for life and play

RO4022378-1124

1 The Empower “Gifted” study, 2024. Among those who say they are giving gifts.

2 U.S. Bureau of Labor Statistics, "Consumer Price Index," October 2024.

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.