The Network Effect

The Network Effect

New Empower research explores the power of network to influence career and money. How do relationships open doors to money making?

New Empower research explores the power of network to influence career and money. How do relationships open doors to money making?

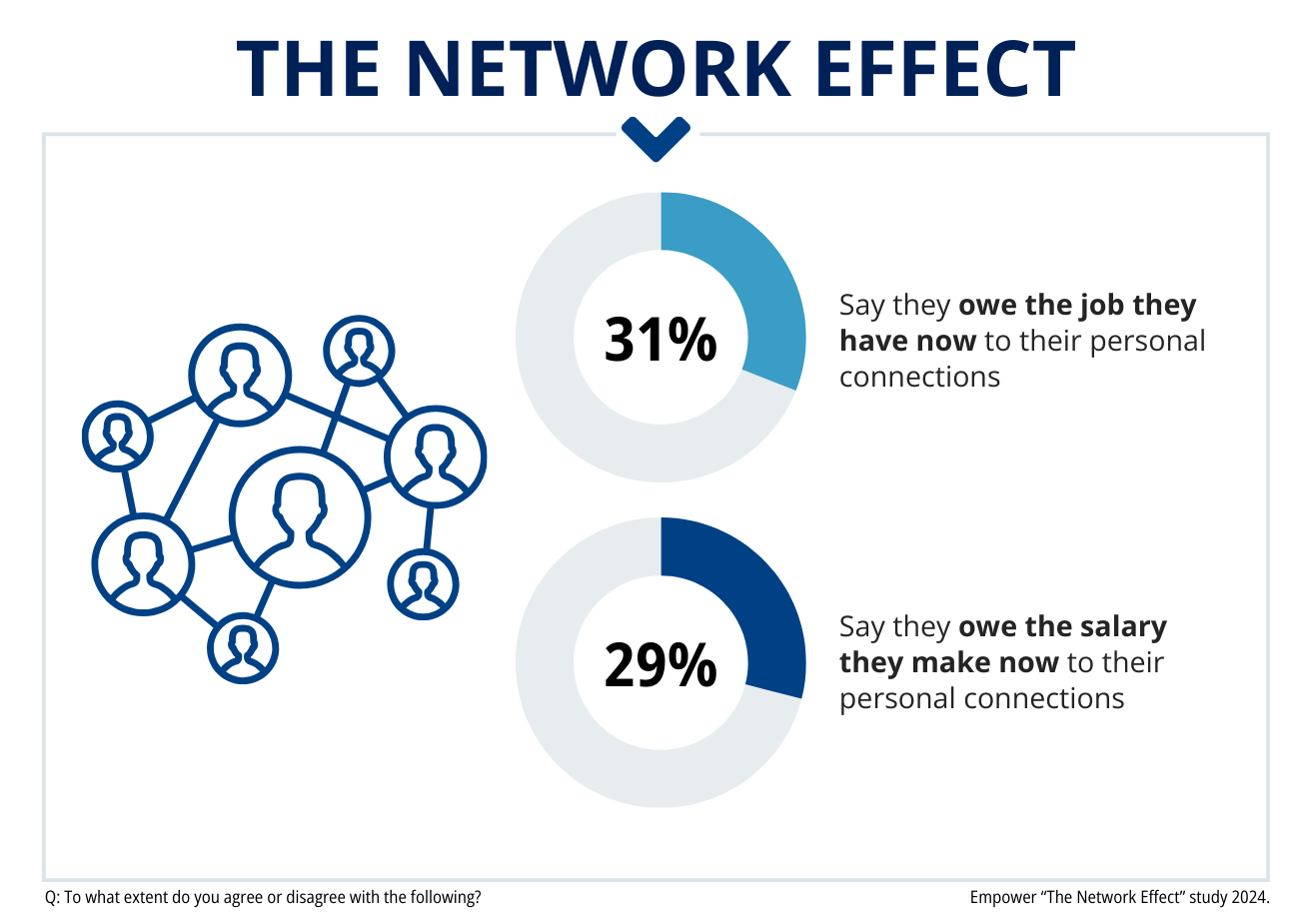

One in three (31%) Americans say they owe the job they have now – and the salary they make (29%) – to their personal network. For Millennials, that number rises to 40% on both dimensions.

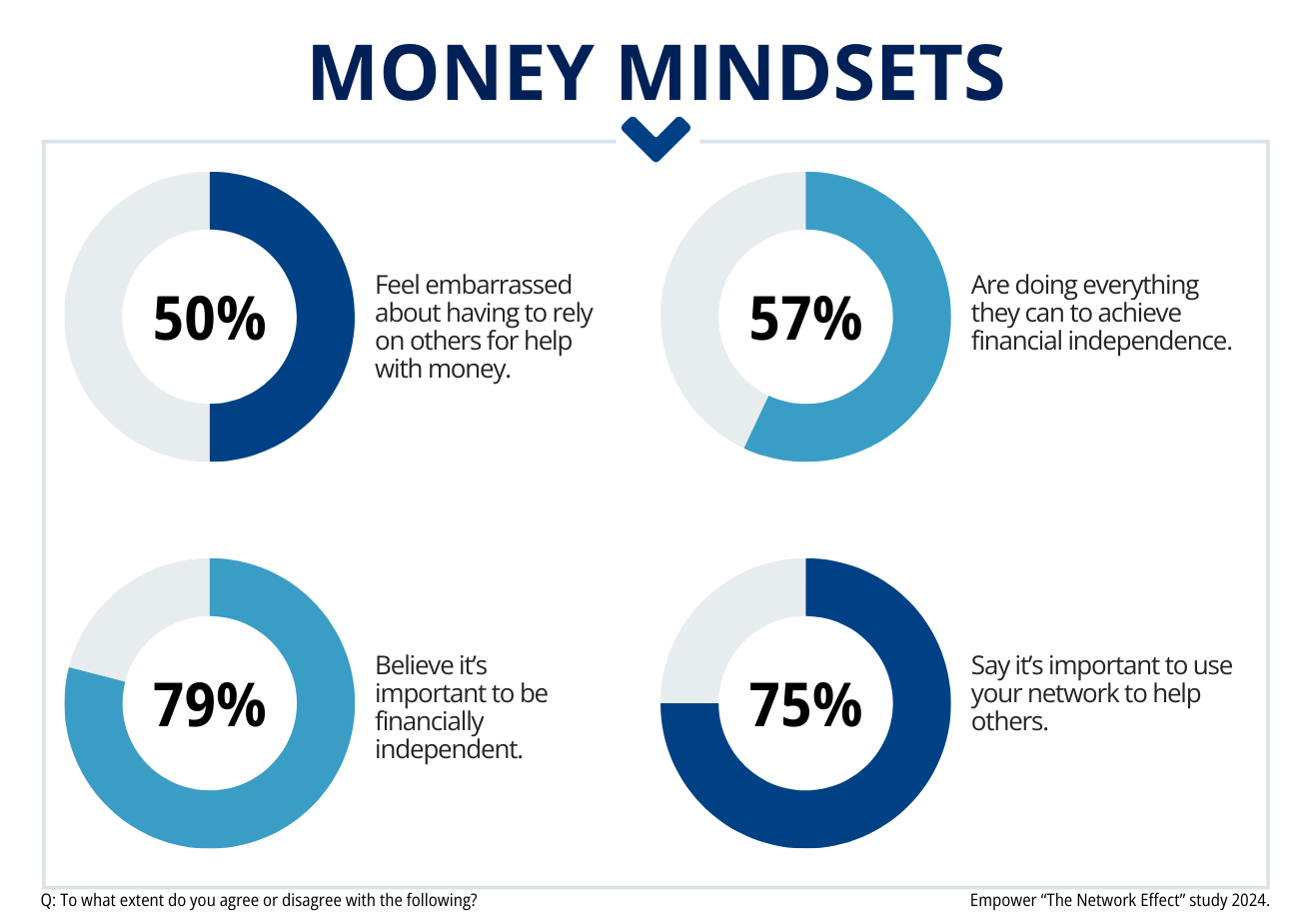

Six in 10 Americans believe that the strength of their connections is key to success, from career advancement to pay and promotions. Half of people (50%) say it would be naive not to take advantage of personal connections. Some 75% say it’s important to use your network to help others, and half of Americans say they’ve actively helped others get a job (53% overall, 61% Millennials).

“The ‘Network Effect’ is real, and your dream salary may be one connection away. Many Americans see the power of personal connections as a key to unlocking moneymaking opportunities,” says Rebecca Rickert, head of communications at Empower. “People view the investment of time or money as a means of paying it forward – an investment that pays back.”

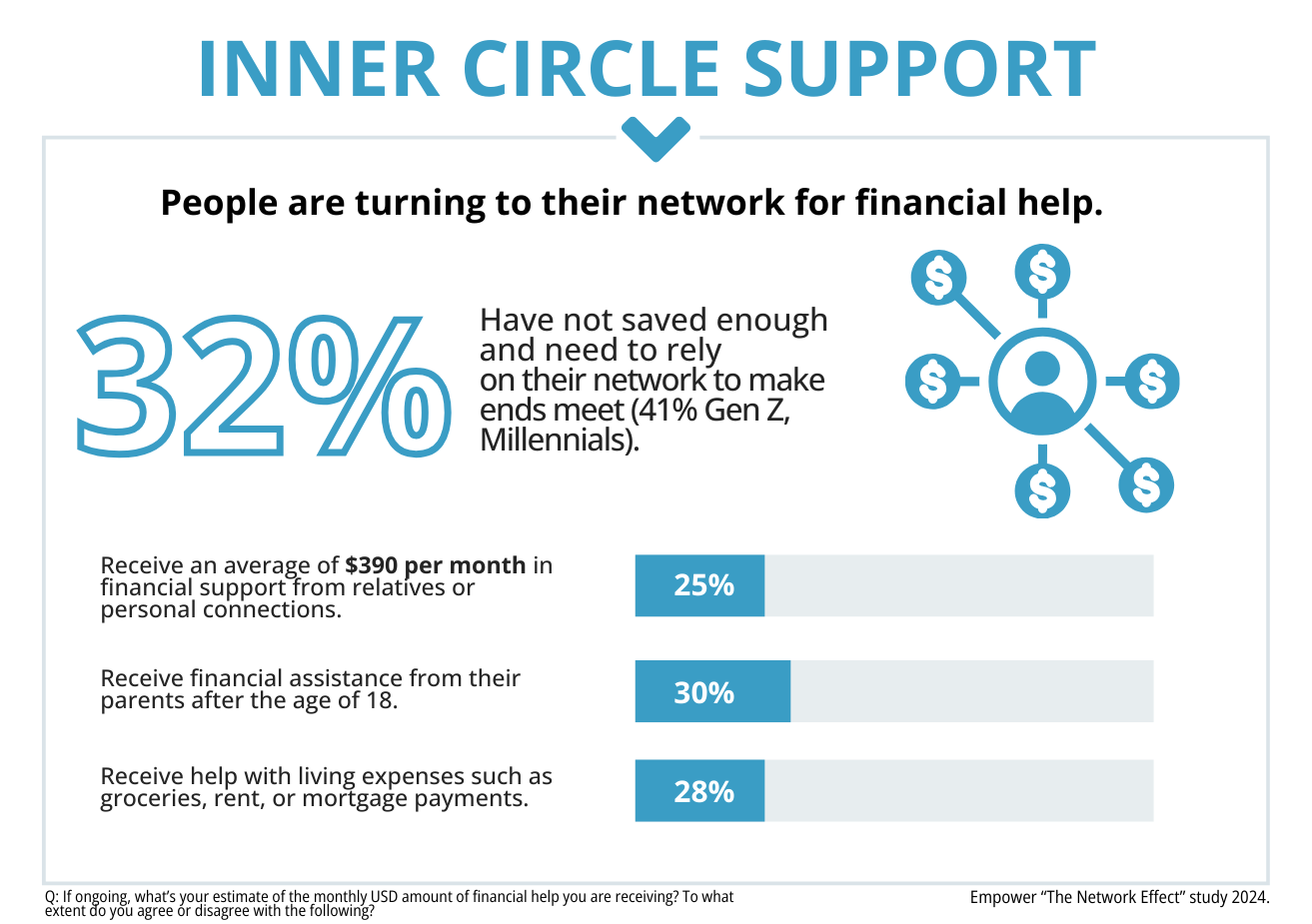

People are also turning to their inner circles for financial help. A third of Americans (32%) say they have not saved enough and need to rely on their network to make ends meet (41% Gen Z, Millennials). One quarter receive an average of $390 per month ($4,680 annually) in financial support from relatives or personal connections. Nearly a third admit to receiving financial assistance from their parents after the age of 18 (30%) — and 45% of parents say they provide financial support to their adult children. Additionally, 28% of people have received help with living expenses such as groceries, rent, or mortgage payments.

Still, 50% feel embarrassed about having to rely on others for help with money, as the majority (79%) of Americans believe it is important to be financially independent and many (57%) are doing everything they can to achieve it. Some 61% say rising prices and inflation are preventing them from getting ahead financially.

The power of personal connections extends to giving back, too: 66% say paying it forward to others in this way increases their happiness. Six in 10 Americans have paid it forward to strangers in small ways, too, like paying for the person behind them in the drive thru.

More findings:

- Generational hardships: 40% overall say their generation needs financial help because they are at a disadvantage compared to other generations (54% Gen Z, 55% Millennials, 36% Gen X, 23% Boomers).

- Keeping up with the Joneses: A quarter say they spend more than they make trying to keep up with others (23% overall, 33% Gen Zers); Men are more likely than women to agree (27% men, 19% women).

- Diploma dilemma: More than 1 in 5 (21%) have received financial help for education from their network. Though, nearly a third say that due to their career choices (e.g., lack of a degree, low-paying jobs) they need to financially rely on others (27% overall, 38% Gen Z, Millennials). Just 7% say they received a legacy admission to a college of choice due to personal connections.

- Opening doors: Some 25% of Americans say they’ve received career support from their parents, including connections, advice, introductions, and professional development. One in 5 Millennials have gotten freelance opportunities due to their personal connections.

- Picking up the bill: One in 4 admit to having daily discretionary expenses like eating out and getting coffee covered by others. 17% of people have enjoyed a fully paid vacation courtesy of their relatives, friends, or personal connections (20% Gen Z and 22% Millennials).

- Family Ties: 58% believe that family members and close friends need to help each other financially; 35% prefer to live at home with family or roommates to save money.

Methodology

Empower’s “The Network Effect” study is based on online survey responses from 2,200 Americans ages 18+ fielded by Morning Consult between August 5-7, 2024. The survey is weighted to be nationally representative of U.S. adults (aged 18+).

RO3854864-0924

Get financially happy

Put your money to work for life and play

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.