Saving

Saving

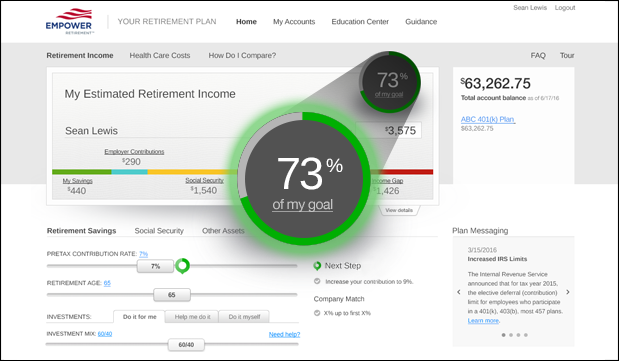

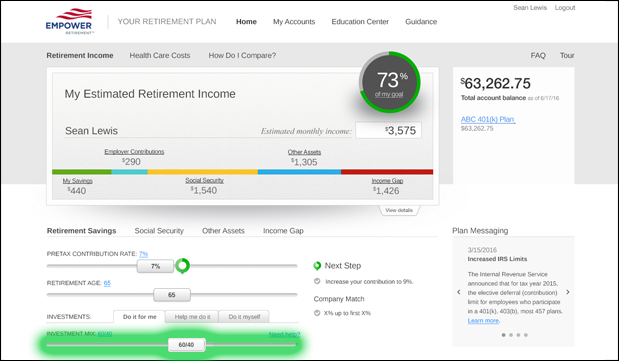

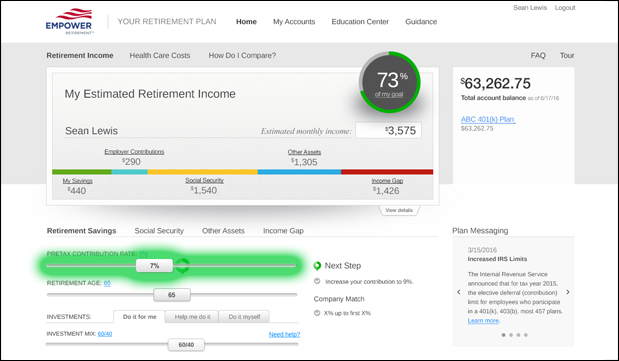

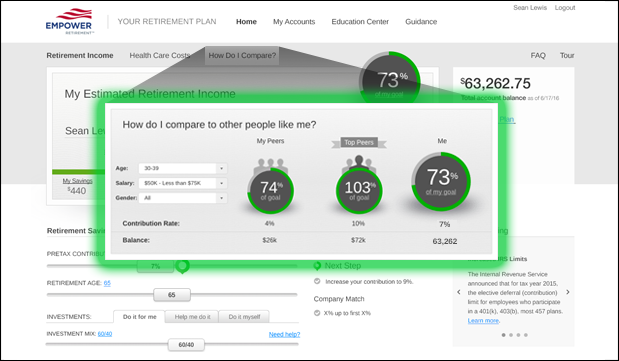

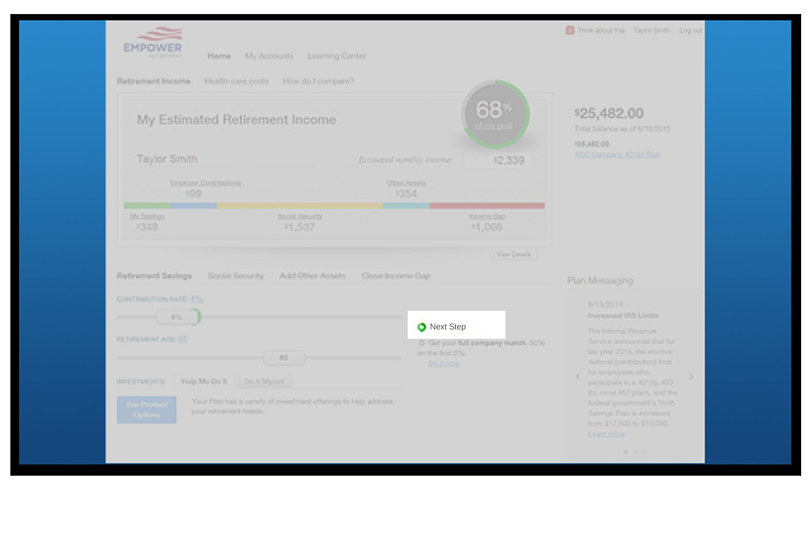

Through your Sony USA 401(k) Plan (the "Plan"), you’ll get an easy-to-understand monthly estimate that simplifies planning for your future.

Make the most of your Plan

Take advantage of these great features that can help you set aside what you’ll need in retirement:

- Easy payroll deductions that allow you to save with every paycheck.

- Pretax contributions that reduce your current taxable income.

- Ability to save up to $18,500 in 2018, plus an extra $6,000 if you’re age 50 or older.

- Additional savings opportunities through after-tax contributions.

Don’t leave money behind!

Sony matches your contribution with $1 for every $1 you contribute, up to 3% of your eligible compensation, and an additional 50 cents on every $1 on the next 3% (a total of 4.5% company match on 6% of your contributions). Check out the details in the plan’s Summary Plan Description or plan documents.

Automatic enrollment gets you started!

You will be automatically enrolled on or about 45 days of your hire date in the plan at a pretax contribution rate of 6%* of your pay unless you choose a different contribution amount or choose to opt out. This means money will be automatically taken from your pay and contributed to your plan account. Also, your contribution rate will increase 1% annually until you reach 10%. Your contributions will be automatically invested in the plan’s default investment option (the Sony Target Date Fund series). You can make an investment election and contribute to any of the investment options available in the plan at any time. You’ll get more information about these plan features soon in the mail.

You can enroll today — log on to the website or call 877-SONY-SAVE (877-766-9728).

*Automatic enrollment is not applicable to temporary or seasonal employees.