The Currency

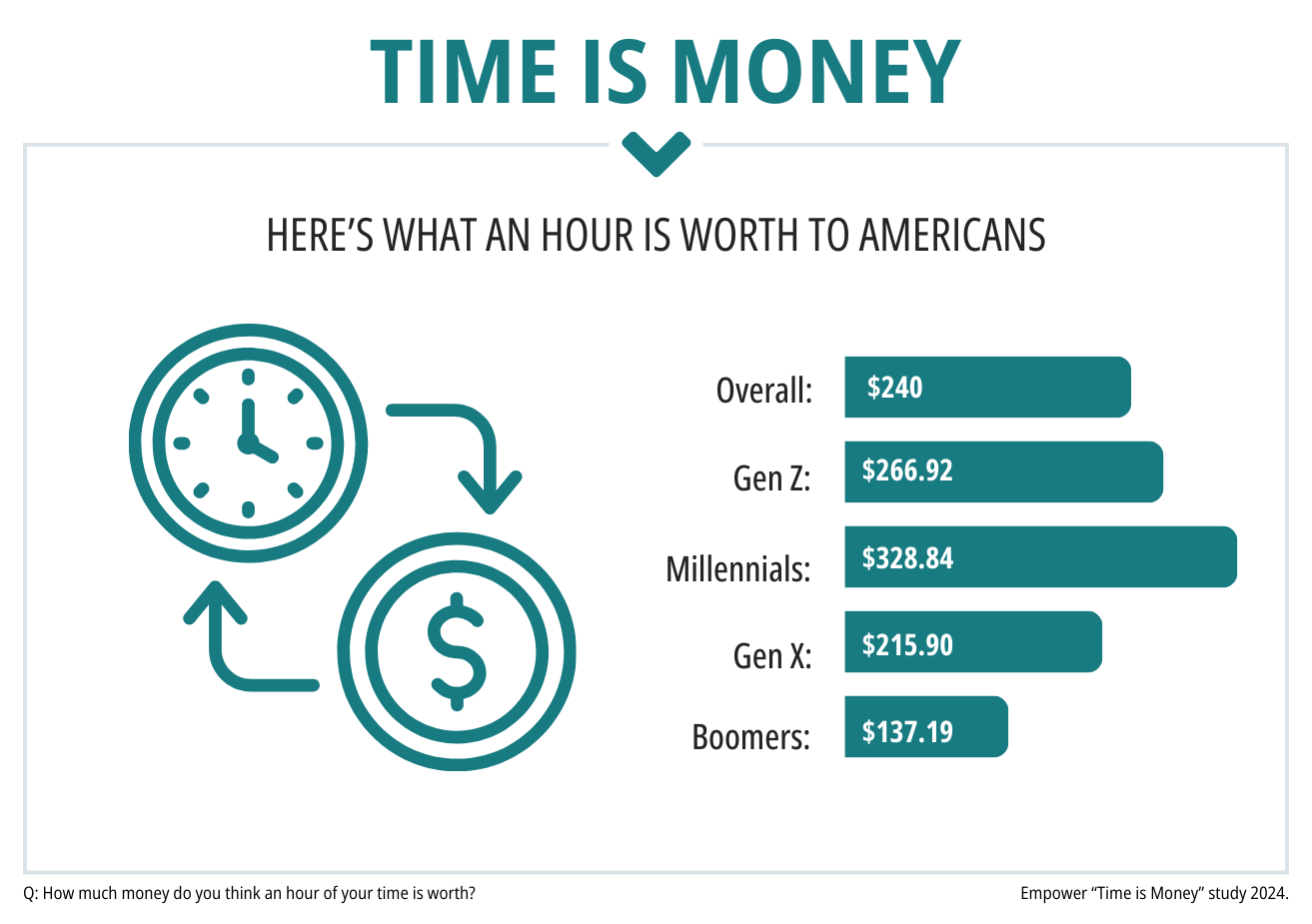

Nearly 2 in 5 Americans say saving time is more important than saving money (37%), and the value of an hour can vary across generations:

Nearly 2 in 5 Americans say saving time is more important than saving money (37%), and the value of an hour can vary across generations:

Adding value: Building the foundation of property wealth

Money

Slug

category--money

Owning real estate can be a cornerstone of long-term prosperity and even generational wealth. The CurrencyTM will be following the latest housing trends in May.

✔️ Checkup

Money

Slug

category--money

Millennials now hold 32% of all HSA accounts and last year, almost half of their contributions were kept as savings. Here's this week's money news.

Brand loyalty is shifting as value takes lead

Life

Slug

category--life

Brand loyalty is facing a serious test as the purchasing decisions of shoppers are being shaped by a new set of priorities — and a willingness to reconsider habits.