We believe everyone deserves access to fiduciary advice

We believe everyone deserves access to fiduciary advice

We offer participants a variety of ways to access the fiduciary advice they want and need.

We offer participants a variety of ways to access the fiduciary advice they want and need.

Empower Dynamic Retirement Manager™

Empower Dynamic Retirement Manager™

Empower Dynamic Retirement Manager (DRM) is a qualified default investment alternative (QDIA). Unlike target date or risk-based funds, DRM offers two professionally managed investment solutions, one for employees starting their careers and a second for those closer to retirement with more complex retirement planning needs.

Today customers have become accustomed to personalized recommendations in many aspects of life. That’s why we believe QDIAs should be as unique as your employees.

How does DRM work?

How does DRM work?

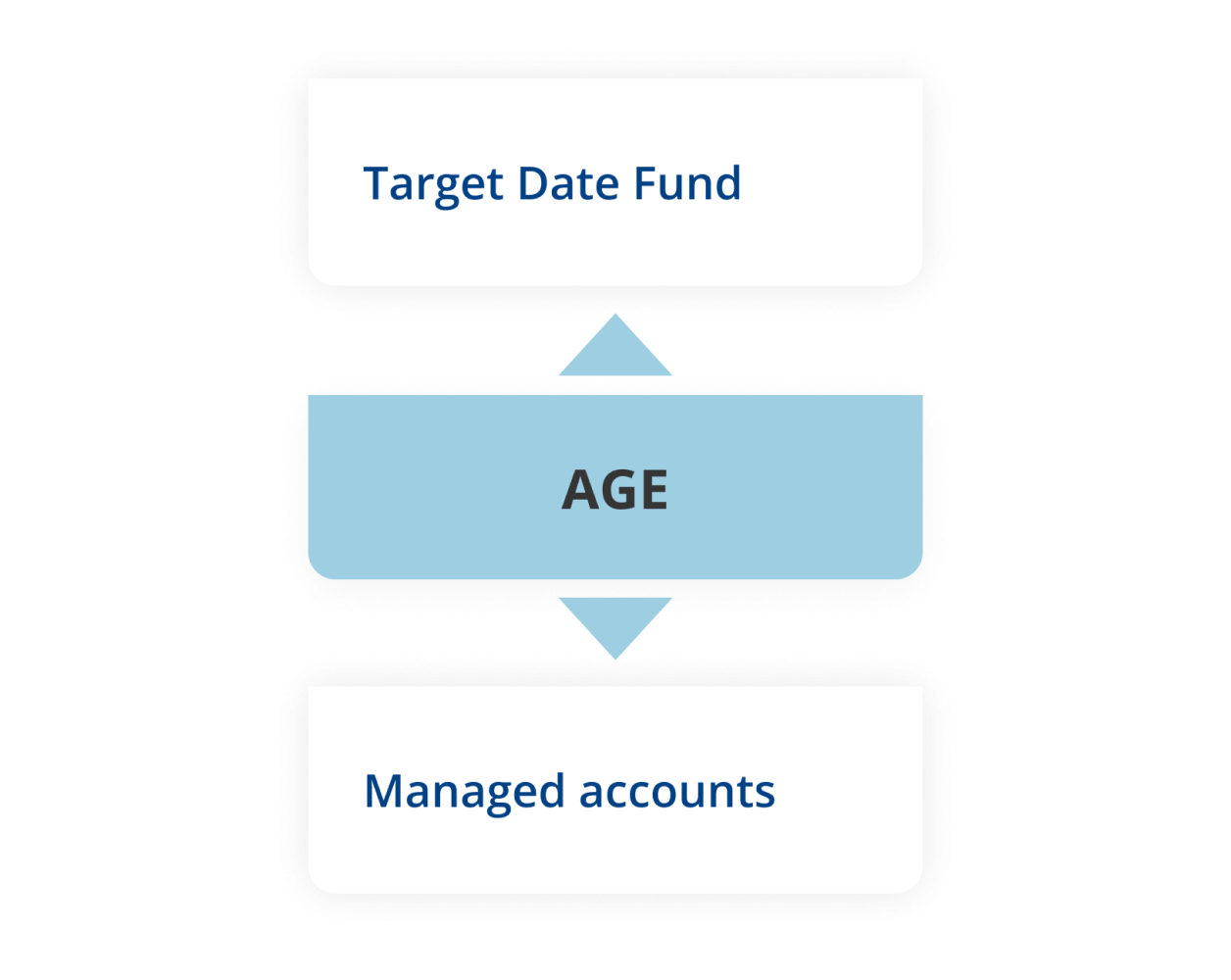

DRM is a dynamic QDIA that integrates the benefits of a target date fund, or model portfolio, with those of a managed account. Employees starting their career are defaulted into a target date fund, for example, and then at an age predetermined by the plan transitioned into My Total Retirement™, the Professional Management Program or Advisor Managed Accounts.1

There is no guarantee provided by any party that participation in any of the advisory services will result in a profit.

The benefits of DRM

The benefits of DRM

DRM helps employees benefit from timely, personalized advice, and personalized advice at the right time may help make a difference. Participants who work with an advisor may be on track to replace more income in retirement. Those who receive advice:

Are 2x more likely to use tax-optimized savings strategies.2

Are 9x less likely to react to market volatility.3

Employees receive an easy-to-understand communications experience through the transition to a personalized retirement strategy

Dynamic Retirement Manager at a glance4

Dynamic Retirement Manager at a glance4

$4B

in assets under management

in assets under management

66K+

participants

participants

1400+

plans

plans

Complements, not substitutes

Complements, not substitutes

Based on this analysis, participants do not consider managed accounts to be substitutes for target date funds.

Dynamic Retirement Manager

Dynamic Retirement Manager

PLANSPONSOR of the Year winner Crate and Barrel shares insights and the success they had implementing Dynamic Retirement Manager.

Does your QDIA still fit your plan?

Does your QDIA still fit your plan?

New DCIIA research provides insight from plan sponsors adopting dynamic QDIAs.

To learn more about making your default as unique as each client contact your sales representative at 877-630-4015

1 My Total Retirement offered through Empower Dynamic Retirement Manager is provided by EAG. The Professional Management Program offered through Empower Dynamic Retirement Manager is provided by EAG. The managed account service offered through Empower Dynamic Retirement Manager is provided by the named registered investment adviser as defined by the advisory services agreement.

2 As of June 1, 2020. Empower recordkeeping data. Advisory Services participants average 10% higher savings rates than target date fund savers and have 16% higher web utilization.

3 As of March 27, 2020. Empower recordkeeping data.

4 As of March 31,2022. Empower recordkeeping data.

Online Advice and My Total Retirement are part of the Empower Advisory Services suite of services offered by Empower Advisory Group, LLC, a registered investment adviser. My Total Retirement offered through Empower Dynamic Retirement Manager is provided by EAG.

Online Advice and the Professional Management Program are part of the Empower Advisory Services suite of services offered by Empower Advisory Group, LLC, a registered investment adviser. The Professional Management Program offered through Empower Dynamic Retirement Manager is provided by EAG.

Online advice and the managed account service are part of the Empower Advisory Services suite of services offered by Empower Advisory Group, LLC, a registered investment adviser.

EFSI is an affiliate of Empower Retirement, LLC; Empower Funds, Inc.; and registered investment adviser Empower Advisory Group, LLC.

FOR FINANCIAL PROFESSIONAL USE ONLY.