Price check: Find out which states spend the most on groceries

Price check: Find out which states spend the most on groceries

Price check: Find out which states spend the most on groceries

Listen

·Consumers are putting more than eggs in their baskets, and their wallets are feeling the pinch. While soaring egg prices and picked-over egg aisles seem to dominate the headlines, supermarket prices on the whole are on a steady climb too. According to the CPI report released in March, food prices increased 2.6% year over year, and the USDA reports that grocery prices on the whole have increased 23.6% since 2020.1

Check it out

The Empower Personal DashboardTM data shows Americans rang up an average of $634 monthly on groceries for the 12-month period ended February 28, 2025.

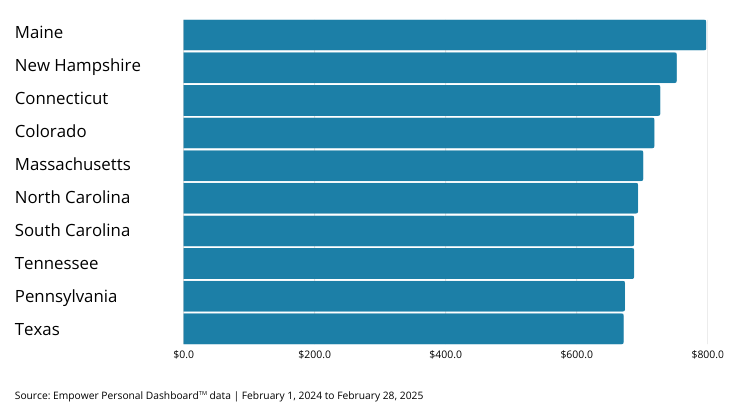

Who’s spending the most at the supermarket? Dashboard data shows four of the five states with the biggest grocery bills are in New England. Americans living in Maine rank highest, forking out $798 monthly on average for the twelve months ending February 28, 2025, followed by New Hampshire ($753), Connecticut ($728), Colorado ($719), and Massachusetts ($702). People in North Dakota spend the lease on average at $494 monthly, based on dashboard data.

States with the highest average monthly grocery spend per individual

Consumers’ approach to food spending may be shifting too. Many Americans enjoy treating themselves to culinary delights, but a recent McKinsey & Company report reveals consumers who intend to splurge on restaurants and groceries dropped to 32% from 37% YOY.2,3 With food prices on the rise, the change may be due to people allocating additional funds to food items that feel more like status quo and less like indulgences.

Read more: Check out these prices: The average cost of groceries by state

The buck stops here

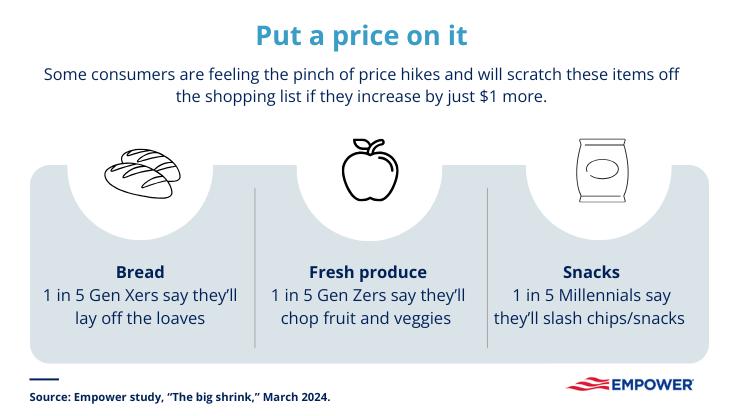

Steady price increases may be feeling like the norm, but consumers say they have a limit: According to Empower research, a majority (87%) say they’re fed up with rising prices in general, and 27% say they’re not willing to pay more for some grocery staples on their shopping lists.

Though the most recent Consumer Price Index (CPI) shows meat, fish, and poultry are up 7.7% YOY, people may not have to give up their carrots and crackers just yet:4 Certain produce is down for the same period, including bananas (-1.3%), tomatoes (-9.7%), and fresh veggies overall (-2.5%), and snacks are down 1.3%.

Read more: Inflation cools in February, but egg prices keep climbing

Hold onto carts

Consumers looking for relief on aisle five may be putting the cart before the horse. Register this: CPI forecasts prices for items like sugar, fresh fruits, and beverages will grow at above-average rates during 2025, and eggs are expected to increase more than 41% during 2025.5

During times of ongoing change, calculating a monthly budget is one way to try to stay financially healthy.

Get financially happy

Put your money to work for life and play

1 USDA Economic Research Service, “U.S. food prices rose by 23.6 percent from 2020 to 2024,” February 14, 2025.

2 McKinsey & Company, “An update on US consumer sentiment: Is growing uncertainty casting a chill on spending plans?” February 28, 2025.

3 McKinsey & Company, “Consumers see a brighter future ahead,” February 29, 2024.

4 Bureau of Labor Statistics, “12-month percentage change, Consumer Price Index, selected categories, February 2025, not seasonally adjusted,” March 12, 2025.

5 USDA Economic Research Service, “Food Price Outlook, 2025,” February 25, 2025.

RO4329670-0325

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.