Back-to-school spending comes with a hefty price tag

Back-to-school spending comes with a hefty price tag

Back-to-school spending comes with a hefty price tag

Key Takeaways

Key Takeaways

- Parents set aside an average budget of $1,200 to keep their kids entertained throughout the summer.

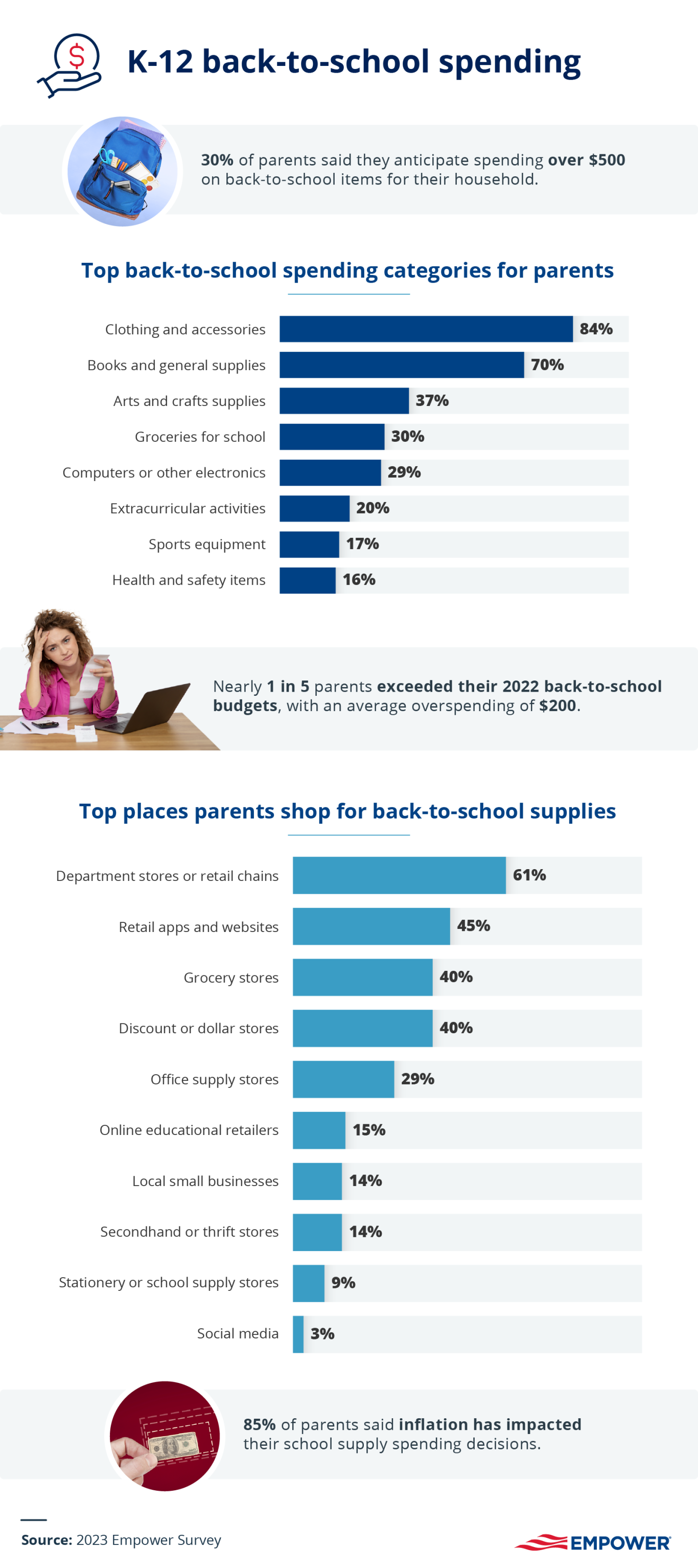

- 3 in 10 parents anticipate spending over $500 on back-to-school shopping for their household this year.

- 40% of parents plan to go back-to-school shopping at a discount or dollar store.

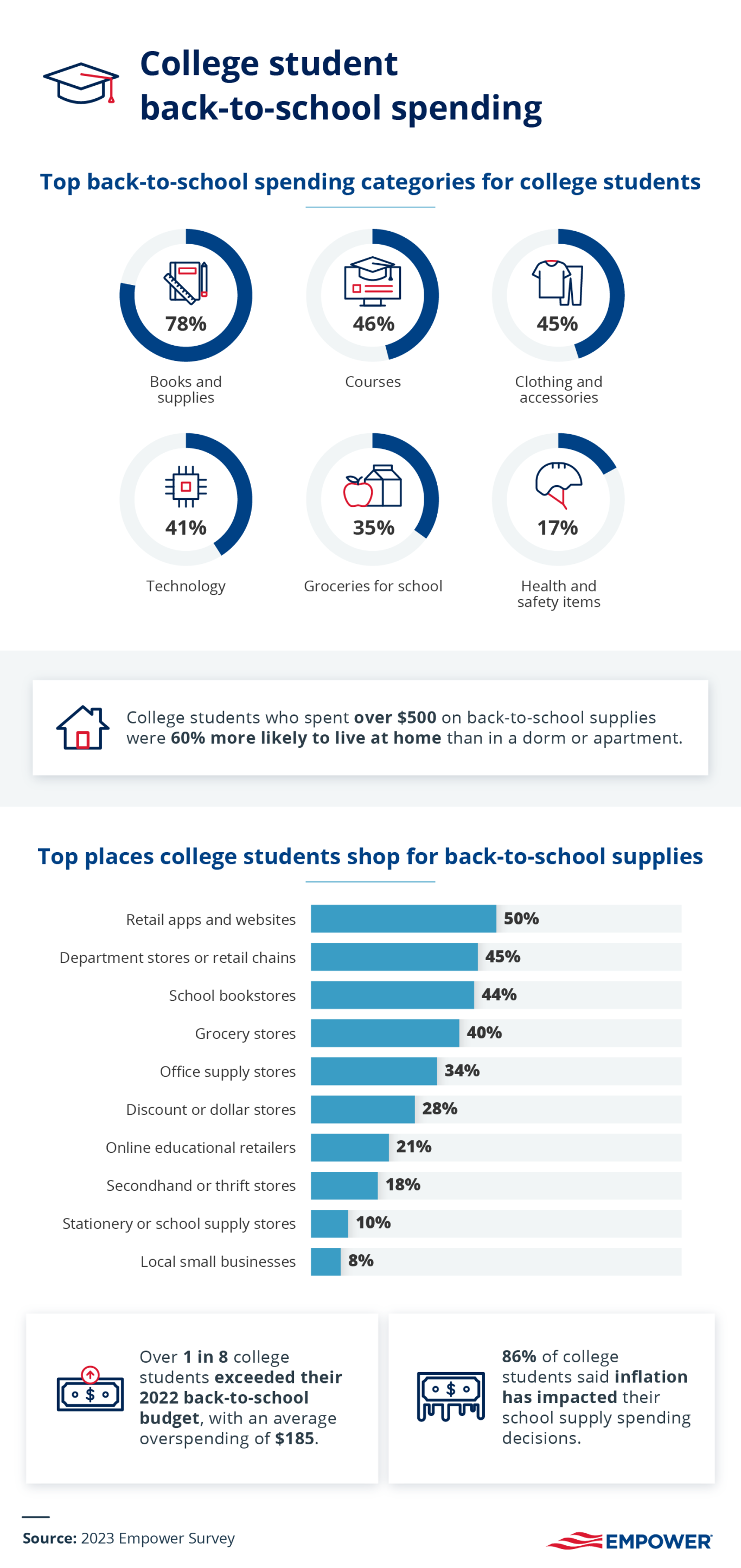

- 86% of college students and 85% of parents say inflation has impacted their school supply spending decisions.

- Parents set aside an average budget of $1,200 to keep their kids entertained throughout the summer.

- 3 in 10 parents anticipate spending over $500 on back-to-school shopping for their household this year.

- 40% of parents plan to go back-to-school shopping at a discount or dollar store.

- 86% of college students and 85% of parents say inflation has impacted their school supply spending decisions.

Summer spending season heats up

Whether your summer schedule is packed with activities or cleared for lazy days at the pool, the end of summer and the beginning of school seem to come faster every year – and come with a price tag. How do parents and college students prepare for back-to-school shopping?

To learn how parents and students are approaching back-to-school spending, Empower surveyed 1,062 Americans, including 857 parents and 205 college students about their spending needs for the new school year, where they find the best deals, and how they use Artificial Intelligence (AI) to help when school’s in session.

Many parents are busy planning summer entertainment for their kids

Nearly half of the parents surveyed felt societal pressure to keep their kids entertained and busy throughout the summer break and set aside an average budget of $1,200 to do so. However, 19% of respondents couldn’t afford summer travel and activities.

That said, many parents are cashing in on free forms of entertainment and inexpensive offerings in their community. The top summer activities parents were adding to their kids’ agendas were as follows:

Carefully budgeting summer activities and taking advantage of affordable local experiences can help parents save money and reduce the financial stress of back-to-school shopping.

Exploring back-to-school budgets, spending categories, and shopping preferences

The majority of K-12 back-to-school budgets are spent on clothing and accessories (84%) and books and school supplies (70%). But notebooks and new jeans don’t come cheap, and 3 in 10 parents said they anticipate spending over $500 on back-to-school shopping. But even large budgets aren’t always enough to cover expenses, as 18% of parents exceeded last year’s back-to-school budgets by an average of $200.

Among those who overspent, 48% said they would do it again this year if needed. However, parents want to get the most out of their budget and have plenty of tricks for making every dollar count. The most popular strategies for saving on back-to-school shopping were as follows:

- Using coupons, discount codes, or promotional offers (66%)

- Shopping during sales events or clearance periods (48%)

- Comparing prices and researching for the best deals (47%)

- Making a list of necessary items (45%)

- Avoiding impulse purchases (44%)

- Cutting back on non-essential expenses (43%)

- Reusing or repurposing items from the previous school year (40%)

- Creating a budget and sticking to it (31%)

- Increasing income through additional work or side hustles (31%)

- Buying in bulk for items used throughout the year (26%)

In addition, parents got creative on where they shopped and looked for deals. Before shopping, 40% of parents searched for deals and discounts on Facebook, and 10% looked on TikTok. When it was time to hit the stores, 40% shopped at discount and dollar stores, and another 14% at secondhand and thrift shops.

Parents weigh in on school year expenses and money conversations

While back-to-school shopping can be a budget buster, school expenses don’t end when classes begin. We asked survey participants about the most common expenses they face throughout the school year, as well as how they prepare their children to become financially independent.

Despite the large budgets spent on back-to-school shopping, 62% of parents said school supplies and books were one of the biggest ongoing expenses throughout the school year, second only to groceries (70%).

Nearly half (49%) of parents said extracurriculars were one of the biggest ongoing school year expenses. Despite the high costs and rising inflation, nearly a third of parents (30%) said they would continue prioritizing these activities for their kids.

However, parents don’t plan on being financially responsible for their children forever, and many are already talking to their kids about money. The difference between needs vs. wants was the most popular conversation between parents and kids, with 70% having had this talk. They also discussed the importance of saving (63%) and the dangers of impulse buying (53%).

As parents teach their kids about money, they often do so with hopes for their children’s financial futures. Among the parents we surveyed, 63% wanted their kids to have enough financial freedom to enjoy life, while the goal for another 60% is that their kids would get a good job and earn enough to pay their bills. Parents also dream about their children being able to afford a home (56%) and hope they’ll prioritize their future financial freedom by saving up for retirement (42%).

To help prepare them for these financially responsible futures, parents gave their children an average weekly allowance of $5. As children learn about saving, budgeting, and other financial habits, 39% of parents hope it will help their children stay financially stress-free.

Is AI a school supply? The expenses of college students

Let’s take a closer look at the spending habits of college students.

Similar to household budgets for K-12 kids, books and supplies were high on the list of biggest back-to-school expenses, with 78% of college students saying it's their top spending category. However, college students did slightly better than parents at sticking to a budget; only 13% of college students exceeded their 2022 budget, compared to 18% of parents. Those who overspent did so by an average of $185.

College students have some tricks for back-to-school deals: 28% shopped at discount or dollar stores, and 18% shopped at secondhand or thrift stores. Students also used social media to search for deals and discount codes, though the platforms for their searches differed from parents. While parents turned to Facebook and TikTok for back-to-school deals, college students were 82% more likely to find money saving hacks on Reddit, with nearly 3 in 10 students using the social forum.

Expenses of college students during the school year

Parents (85%) and college students (86%) overwhelmingly agreed that inflation will affect their back-to-school spending decisions. According to college respondents, here are their top expenses:

While the use of ChatGPT on college campuses is still up for debate as educational institutions have concerns about plagiarism, only 14% of students used this AI technology to write papers or solve math equations. Instead, they most often used AI for idea generation and brainstorming (37%), explanations of complex topics (30%), and proofreading and editing (22%).

Planning for a strong financial future

Parents can use back-to-school shopping as an opportunity to talk to their kids about money to help instill good financial habits early. As for college students, it’s never too late to practice important financial skills like budgeting and creating savings goals. With open conversations, the right tools, and consistent saving, parents and kids alike can build a brighter financial future.

About Empower

Empower is a financial services company on a mission to empower financial freedom for all. We offer investment, wealth management, and retirement solutions for individuals and all sizes of organizations. Connect with us on Empower.com.

Fair use statement

Gearing up for back-to-school shopping? Feel free to share this article with anyone you’d like for non-commercial purposes only; you must provide a link back to this page so readers can access our full findings.

RO2990270-0723

Methodology: Empower survey of 205 college students and 857 parents of K-12 students, conducted in June 2023 by Fractl on behalf of Empower. All data referenced in the article is from this survey.

Empower Retirement, LLC and its affiliates are not affiliated with Fractl.

Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness, or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement, responsibility, or approval by Empower of the contents on such third-party websites.

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. No part of this blog, nor the links contained therein is a solicitation or offer to sell securities. Compensation for freelance contributions not to exceed $1,250. Third-party data is obtained from sources believed to be reliable; however, Empower cannot guarantee the accuracy, timeliness, completeness or fitness of this data for any particular purpose. Third-party links are provided solely as a convenience and do not imply an affiliation, endorsement or approval by Empower of the contents on such third-party websites. This article is based on current events, research, and developments at the time of publication, which may change over time.

Certain sections of this blog may contain forward-looking statements that are based on our reasonable expectations, estimates, projections and assumptions. Past performance is not a guarantee of future return, nor is it indicative of future performance. Investing involves risk. The value of your investment will fluctuate and you may lose money.

Certified Financial Planner Board of Standards Inc. (CFP Board) owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™, CFP® (with plaque design), and CFP® (with flame design) in the U.S., which it authorizes use of by individuals who successfully complete CFP Board's initial and ongoing certification requirements.