We help you invest

We help you invest

The Empower Premier Investment Account:

A simple way to invest for all your financial goals.

A perfect match

A perfect match

Your goals. Our guidance. One investment account.

The Empower Premier Investment Account is designed to help you invest for your financial goals your way - no matter how much you want to invest or how involved you want to be in your investment choices.

You can use the Empower Premier Investment Account for multiple financial goals

You can use the Empower Premier Investment Account for multiple financial goals

New car, dream vacation, college, retirement, windfall investment, home improvement.

Flexibility

Flexibility

Put your money to work

Put your money to work

Convenience

Convenience

Low cost

Low cost

Exclusive loyalty program

Exclusive loyalty program

Award-winning service

Award-winning service

An easy way to invest with no investment limits, and no set up, closure or administrative fees.

An easy way to invest with no investment limits, and no set up, closure or administrative fees.

Other fees may apply.

None

None

Minimum investment

None

None

Maximum investment

$0

$0

Account opening fee

$0

$0

Administrative fees

$0

$0

Transaction fees

$0

$0

Closure fee

Whatever your investing style, the Premier Investment Account is built around you.

Whatever your investing style, the Premier Investment Account is built around you.

The Empower Premier Investment Account is intended for knowledgeable investors who acknowledge and understand the risks associated with an investment account.

Do-it-myself investing

Do-it-myself investing

Invest confidently online based on your risk tolerance and investing timeline with:

• A range of mutual fund options for easy diversification.

• Easy-to-use investment tools.

• Personalized guidance and actionable information always available to you.

Do-it-for-me investing

Do-it-for-me investing

Let our experienced advisors invest on your behalf based on information you provide about your unique goals and financial situation.

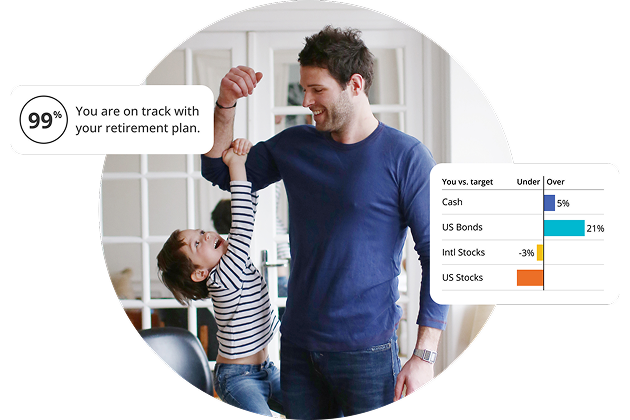

Through My Total Retirement,1 our managed account service, you can take advantage of:

• Professional account monitoring and management.

• Access to advice and savings recommendations.

• Consultations with investment adviser representatives.

• A hands-off approach to investing.

• Comprehensive tax-optimization features.

Flexibility

Flexibility

Use the Empower Investment Account to invest for virtually any financial goal. Enjoy no minimum or maximum investment limits and a wide range of investment fund choices.

Put your money to work

Put your money to work

Access investments that generally have higher long-term growth potential than a typical savings account. Keep in mind that investments with higher return potential carry higher risk.

Convenience

Convenience

Invest easily and confidently using our website and online tools. Access personalized guidance from an advisor whenever you want it.

Low Cost

Low Cost

Pay no account opening or ongoing maintenance fees and no commissions on funds. Other fees may apply; click here to view all fees.

Exclusive loyalty program

Exclusive loyalty program

Gain added benefits based on your asset level, such as access to additional offers and services. Balances over $100,000 qualify for a dedicated financial advisor.

1 Online Advice and My Total Retirement are part of the Empower Advisory Services suite of services offered by Empower Advisory Group, LLC, a registered investment adviser. Past performance is not indicative of future returns. You may lose money.

“EMPOWER” and all associated logos, and product names are trademarks of Empower Annuity Insurance Company of America.

Please consult with your investment advisor, attorney and/or tax advisor as needed.

Be aware that certain mutual funds may be subject to separate and additional redemption fees imposed by the particular fund. Refer to that fund’s current prospectus for details. Transaction fees may apply to certain mutual funds. Transaction fees, where applicable, will be noted during online order entry or via your registered representative during broker-assisted trades.

This site is designed for U.S. residents. Non-U.S. residents are subject to country-specific restrictions.

Empower Financial Services, Inc., Inc. reserves the right to change and/or modify pricing.

The content contained on this website has been prepared for informational and educational purposes only and is not intended to provide investment, legal or tax advice.