Your helping hand to invest well

Your helping hand to invest well

Get guidance to make better money decisions at every stage of your life.1

Real people answer your money questions

Are you diversified enough? Unsure about your allocations? See where your money stands — and get help from professionals for your next move.1

Your personal board of advisors

Got complex money decisions? You’re not on your own. A fiduciary financial advisor supports you in growing your wealth for the long-term.1

Custom strategies built for a holistic view of your situation

For qualified investors, bespoke strategies and tax optimization may reduce what you owe and keep more in your wallet.2

Get smart with money at every life stage

Whether you’re saving for your honeymoon or your empty nest, Empower can help you save smarter and spend better.

-

When your life changes, your financial plan can keep up

Meet the fiduciary advisor leveling up your strategy with personalized financial guidance for every life stage.1

-

Premium investing support for your future

Qualified investors get white-glove support and value with custom portfolio management services.2

-

Stash your cash for the next time you need it

Earn 3.25% APY6 with Empower Personal Cash™. No account fees, no minimums, direct deposit, and withdrawals of up to $100K.7

-

Consolidate your retirement savings

Enjoy a wide range of investment options, no admin fees and guidance from a professional when you roll over your old retirement accounts.8

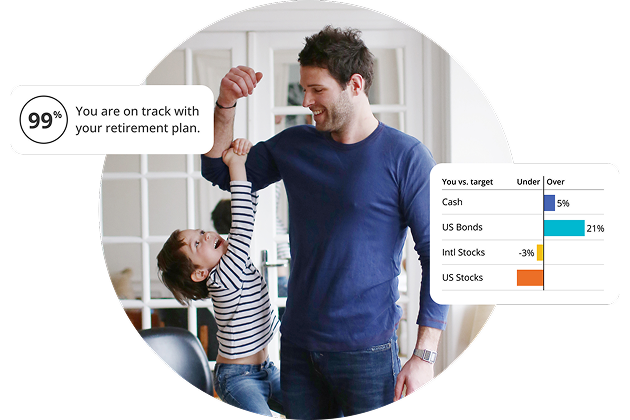

Are you maximizing your retirement savings?

Are you maximizing your retirement savings?

Stay on track with your goals. Access tools to adjust your retirement plan to fit your changing needs and lifestyle.

A breath of fresh air after being kept in the dark by previous management service. Love that you educate those of us without any investment education.

Christian K.

Non-paid client of Empower Advisory Group, LLC*

Get money news and viewpoints

Get money news and viewpoints

10 questions before hiring a financial advisor

Fiduciary advisors: What they do and why it matters

How much should I save for retirement?

Getting good at money starts when you see the full picture

Connect your accounts to see your investments, cash, credit, and more in one place. We offer leading security measures like encryption, multi-factor authentication, and fraud protection to keep your data safe.

1 Personal Strategy® advisory services are available when you invest more than $100,000 with us.

2 Private Client advisory services are available when you invest more than $1M with us.

3 As of September 30, 2025. Assets under administration (AUA) refers to the assets administered by Empower. AUA does not reflect the financial stability or strength of a company.

4 Average satisfaction rating based on 1,424 responses to customer survey conducted between January 1, 2024 - September 30, 2024.

5 Empower satisfaction survey and IVR data as of June 2022.

6 Empower Personal Cash™ Program is offered through Empower Personal Wealth, LLC (“Empower”). Empower is not an FDIC-insured bank and deposit insurance covers the failure of an insured bank. Bank deposit products provided by UMB Bank n.a., Member FDIC (“UMB”). Certain conditions must be satisfied for pass-through deposit insurance coverage to apply. To participate in the program, you must open an account at UMB, through which your funds will be placed in accounts at participating program banks (which may include UMB). The advertised interest rates are paid by participating program banks, including by UMB in its capacity as a participating program bank. Your funds will be FDIC insured up to applicable limits while in transit through UMB. UMB receives a fee from each program bank (except UMB) in connection with the program that is based on the aggregate daily closing balance of deposits held in program accounts by such program bank. The fee may vary from program bank to program bank and will generally increase as the aggregate amount of funds held in program accounts with the program bank increases.

The Empower Personal Cash™ Annual Percentage Yield (APY) as of of 10/31/25 is 3.25% APY (3.203% interest rate). The calculation for APY is rounded to the nearest basis point. Both the interest rate and APY are variable and subject to change at UMB’s discretion at any time without notice.

The information provided in your account application is being provided by you to UMB. UMB may share this information with UMB’s affiliates and with EMPOWER, each of which may use this information in accordance with its respective privacy policy. Upon acceptance of the application, an account will be opened with UMB.

7 FDIC insurance up to $250,000 (including principal and interest) per depositor per program bank. The cash balance you place through the program is swept to one or more program banks, where it earns a variable rate of interest and is eligible for FDIC insurance. If the number of program banks changes, the aggregate amount of available FDIC insurance could be higher or lower. If you have deposits at a program bank, you should consider electing not to use that bank by following the opt-out instructions we provide. If you do so, the aggregate amount of FDIC insurance available to you will be lower. If you do not do so, your existing deposits and deposits through Empower Personal Cash™ at that program bank will be combined for the purposes of FDIC coverage, which could result in some of your funds at that program bank being uninsured. You can find a list of the program banks here: docs.empower.com/PDF/p/cash/program-banks.pdf

8 Other account fees, fund expenses, brokerage or service fees may apply.

Advisory services are provided for a fee by Empower Advisory Group, LLC (EAG). EAG is a registered investment adviser with the Securities and Exchange Commission (SEC) and an indirect subsidiary of Empower Annuity Insurance Company of America. Registration does not imply a certain level of skill or training. Investing involves risk. Past performance is not indicative of future returns. You may lose money. Advisory fees are calculated based upon the amount of assets being managed (as detailed further in the Empower Advisory Group, LLC Form ADV).

Investing involves risk, including possible loss of principal.

*Testimonials may not be representative of the experience of other individuals and are not a guarantee of future performance or success.

Unless otherwise noted: Not a Deposit | Not FDIC Insured | Not Bank Guaranteed | Funds May Lose Value | Not Insured by Any Federal Government Agency

Securities, when presented, are offered and/or distributed by Empower Financial Services, Inc., Member FINRA/SIPC. EFSI is an affiliate of Empower Retirement, LLC.