Breadcrumb

- Individuals

- Products & Solutions

- Wealth Management

- Personal Strategy

Personal Strategy®

Portfolio management & financial planning for life

Portfolio management & financial planning for life

Get guidance to help you make smart financial decisions from today to retirement.

For a limited time, get an iPad® when you invest $100K in taxable assets, or invest $250K+ and get a MacBook®.† Terms and conditions apply.

Empower lives up to its name: Our wealth management consultant empowers us to make the right decisions that move us towards our goals. They always have our best interest in mind, and have simplified retirement planning and achieving our financial goals.

Matthew H.

Non-paid client of Empower Advisory Group, LLC§

Your financial strategy & nobody else’s

Proactive planning, dedicated guidance, and tools to help you invest well and live a little.

-

Responsive advisors

Accessible and attentive — your team is here when you need them.

-

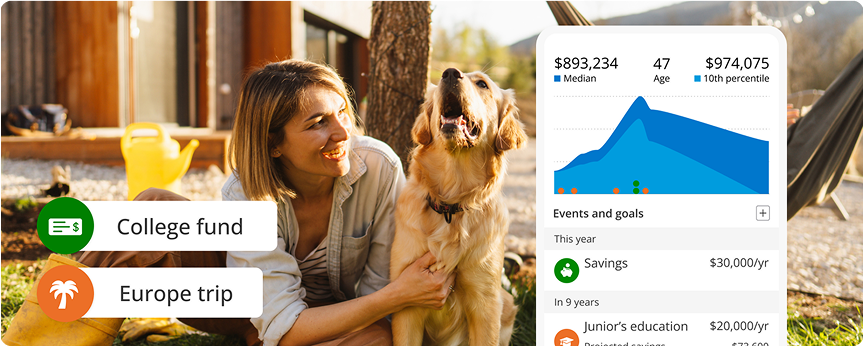

Ongoing financial planning

Guidance from financial planning specialists helps refine your strategy.

-

Unbiased advice

Your success is our priority. We work for you, not on commission.

-

Innovative technology

Clearly see how today’s decisions could impact your financial future.

Tell us where you want to go

If you have $100,000 or more in investable assets, it may be time to consider wealth management. That’s where we come in.

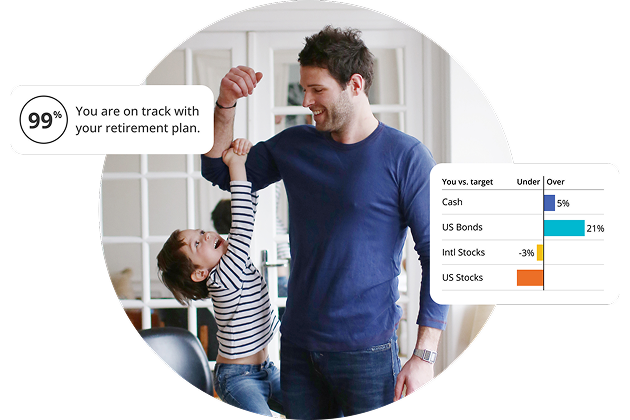

Personalized portfolio design

Experience a tailored investing strategy that adjusts with your changing needs.

Unique diversification method

Designed to help manage risk and support growth, our Smart Weighting™ approach helps keep your portfolio balanced.

Daily portfolio monitoring

Financial professionals + advanced technology monitor your account for rebalancing opportunities.

Flexible investing choices

Customize your portfolio with options that reflect what’s important to you.

Tax optimization

With a proactive tax approach, you may be able to reduce your tax burden.

Three-part strategy

Our sophisticated process focuses on three key areas: Asset location, tax-loss harvesting, and tax efficiency.1

Reduce tax exposure

Tax optimization may improve your after-tax returns, depending on your circumstances and market conditions.2

Track everything in your dashboard

Keep tabs on your portfolio, trades, performance, income, balances, and projections, all in one place.

Coaching to help you stay on course

Learn how to navigate emotional or complex decisions, which may help improve long-term financial outcomes.5

Transparent advisory fee

We charge an annual advisory fee as a percentage of your total assets under management (AUM), using a tiered fee structure. No hidden fees, no trailing fees, and no trade commissions. Your “all-in” cost is a combination of our advisory fee and any ETF expense ratios.3

| Assets | Annual fee |

|---|---|

| INVESTMENT SERVICES CLIENTS | |

| $100,000-$249,999 | 0.89% |

| WEALTH MANAGEMENT CLIENTS | |

| $250,000-$999,999 | 0.89% |

| PRIVATE CLIENTS | |

| First $3M | 0.79% |

| Next $2M ($3,000,001 - $5M) | 0.69% |

| Next $5M ($5,000,001 - $10M) | 0.59% |

| Amount over $10M | 0.49% |

| Family tiered billing4 | 0.79% |

Compare our wealth management services5

|

Financial advisor |

|

Tax optimization |

|

Disciplined rebalancing |

|

Dynamic portfolio allocation |

|

Education & college planning |

|

Private equity access** |

|

Private banking services |

|

Tax & estate planning |

Value you can see

Enhance your annual return by as much as:

*Some advisors charge $100/hour or more for these types of services. That means you could expect to pay anywhere from $2,000 to $5,000 for a single item.7

Let's talk

Meet with an advisor for an in-depth financial review. From the first conversation, our focus is on you and your goals.

Getting good at money starts when you see the full picture

Connect your accounts to see your investments, cash, credit, and more in one place. We offer leading security measures like encryption, multi-factor authentication, and fraud protection to keep your data safe.