Dedicated advisor

Dedicated advisor

A successful strategy requires the support of a trusted advisor who not only listens, but truly understands you. We aim to build lasting client relationships that start with strong communication.

We know money can be emotional, and emotional decisions usually lead to bad outcomes. Our advisors are trained in behavioral coaching that is designed to help you make the most informed decisions possible. Most individual investors lag the market, primarily due to poor decision-making with their investments. A Vanguard study estimates advisors can add 2.00%*, if not more, over time by helping clients stick with their appropriate allocations.

*Vanguard Advisor’s Alpha: “Quantifying Your Value to Your Clients” (July 2022).

The best of tech + human insight

The best of tech + human insight

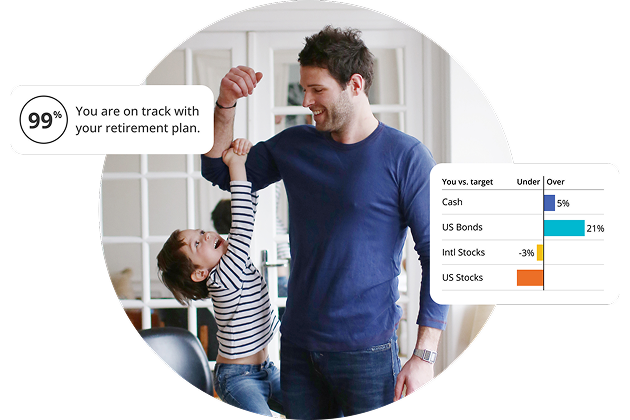

- Work with your advisor to build a personalized plan.

- Get answers to your questions, and discuss changes in your situation.

- Your advisor can help you take the emotion out of your decisions.

Our advisors work closely with our team of specialists and are there to assist you with any planning-related needs. If you were to purchase these services a la carte from another provider, it would not be unusual to pay several thousand dollars1 — or more. Even then, we don’t think it’s a true comparison with what we offer. Why? Because of our unique approach, which integrates our technology within the advisory relationship. Our client-only financial planning tools are just one example of how we enhance the financial-planning experience.

Your advisor will also review your Personal Strategy with you and is always available to answer any questions that arise. We believe it is important to give you a transparent, real-time view into how we’re managing your money, which is why we have created the Personal Strategy Dashboard view for our clients. Here you can see all activity specific to your Empower non-plan managed accounts: trades, trade reasons, performance, portfolio income and balance, projections, monthly statements, and more.

Advantages of your Personal Strategy

Advantages of your Personal Strategy

Tax optimization

Tax optimization

Our sophisticated tax-optimization process focuses on three key areas: asset location, tax-loss harvesting and tax efficiency.

Disciplined rebalancing

Disciplined rebalancing

We review portfolios daily for rebalancing opportunities. This provides the potential for enhanced returns by creating a systematic way of buying low and selling high.

Smart Weighting™

Smart Weighting™

Smart Weighting provides more even exposure to factors such as size, style, and sector, potentially providing opportunity for better diversification for your portfolio.

Dedicated advisor

Dedicated advisor

Your own dedicated service advisor will be there along the way to help with financial planning needs and behavioral coaching.

Advisory services are provided for a fee by Empower Advisory Group, LLC (“EAG”). EAG is a registered investment adviser with the Securities and Exchange Commission (“SEC”) and an indirect subsidiary of Empower Annuity Insurance Company of America. Registration does not imply a certain level of skill or training. Investing involves risk. Past performance is not indicative of future returns. You may lose money. Advisory fees are calculated based upon the amount of assets being managed (as detailed further in Empower Advisory Group, LLC’s Form ADV.