Personal Strategy®

Tax optimization

Personal Strategy®

Tax optimization

Tax expenses can significantly detract from an investor’s portfolio return. As part of your Personal Strategy, we take a three-pronged approach to tax optimization by focusing on asset location, tax-loss harvesting and tax efficiency. Comprehensive tax optimization can increase after-tax return by up to 1% per year.1

In order to minimize the tax consequences within an investment portfolio, the tax attributes of each account type and security must be considered.

Types of accounts by tax characteristics

Types of accounts by tax characteristics

Three ways we optimize for taxes

Three ways we optimize for taxes

Advantages of your

Personal Strategy

Advantages of your

Personal Strategy

Tax optimization

Tax optimization

Our sophisticated tax-optimization process focuses on three key areas: asset location, tax-loss harvesting and tax efficiency.

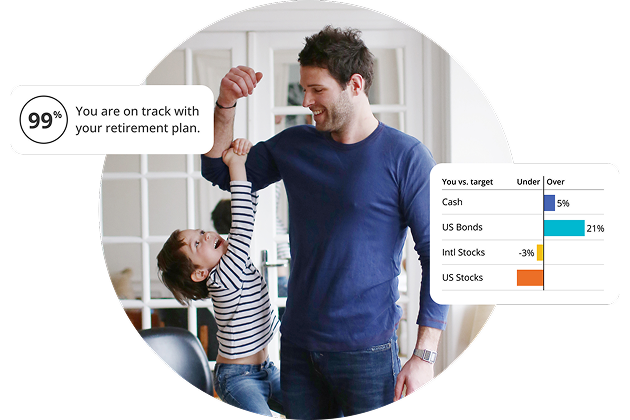

Disciplined rebalancing

Disciplined rebalancing

We review portfolios daily for rebalancing opportunities. This provides the potential for enhanced returns by creating a systematic way of buying low and selling high.

Smart Weighting™

Smart Weighting™

Smart Weighting provides more even exposure to factors such as size, style, and sector, potentially providing opportunity for better diversification for your portfolio.

Dedicated advisor

Dedicated advisor

Your own dedicated service advisor will be there along the way to help with financial planning needs and behavioral coaching.

1 The average tax cost ratio of equity mutual funds is 1.0% to 1.2%, according to Morningstar. By avoiding tax-inefficient funds and adding the benefit from tax location and tax loss harvesting, our research shows proper tax management can improve portfolio returns by up to 1.0% annually. Sources: Rushkewicz, Katie, “How Tax-Efficient is your Mutual Fund?” 15 February 2010. Morningstar. 17 January 2011; Vanguard Study. Average tax cost is calculated based upon Morningstar data for all domestic equity stock funds with 15 years of performance history as of September 30, 2014. Calculations assume account is not liquidated at the end of the period. When after-tax returns are calculated, it is assumed that an investor was in the highest federal marginal income tax bracket at the time of each distribution of income or capital gains. State and local income taxes are not reflected in the calculations. After-tax distributions are reinvested, and all after-tax returns are also adjusted for loads and recurring fees using the maximum front-end load and the appropriate deferred loads or redemption fees for the time period measured.

2 Model Assumptions: Available Loss is equal to 10% of portfolio assets, with average loss of those assets being 15%. Tax rate assumptions use a low to high range for capital gains of 15%-36.2% and income 15%-51.9% respectively. This assumes federal gains rates = 15%-23.9%, state gains rate = 0%-12.3%, federal income rate = 15% - 39.6%, and state income rate = 0% to 12.3%. Small Portfolio is defined as an investment portfolio with taxable value less than or equal to $200,000. Loss harvesting benefits assume some desire to rebalance. There would be reduced benefit compared to a buy and hold forever strategy. Represents tax savings in current year. Some savings represent a tax deferral and may lead to increased future tax if portfolio is liquidated. Loss harvesting opportunities tend to reduce over time as winners accumulate.